In this article, I will detail my trading strategy designed to pass the FundedNext $50,000 Challenge successfully. This strategy revolves around key market principles and precise execution steps to enhance the probability of profitable trades.

1. Identify a Trend Pair and Form Your Bias

The first step in my strategy is to identify a clear trend in the market. This involves analyzing the price action to determine whether the market is trending upwards (bullish) or downwards (bearish). Establishing a clear trend helps form a bias, guiding the direction of your trades.

2. Identify a Point of Interest (POI)

Once the trend is identified, the next step is to locate a support or resistance level, also known as a Point of Interest (POI). These levels are critical as they represent areas where the price is likely to react. Wait for the price to approach these levels, as they provide potential entry points for trades.

3. Monitor the Retracement on Lower Timeframes

With the POI identified, I monitor the price action on a lower timeframe, specifically the 5-minute chart. This allows for a closer look at the market dynamics as the price retraces towards the POI. Monitoring retracements helps in timing the entry more precisely.

4. Drop to a Lower Timeframe

When the price reaches the POI, I switch to an even lower timeframe, maintaining the 5-minute chart for detailed observation. This step is crucial for detecting micro-structural changes in the price action that can signal potential trade opportunities.

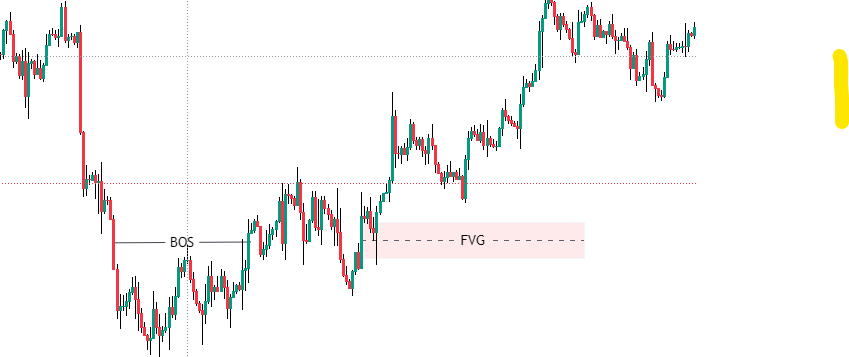

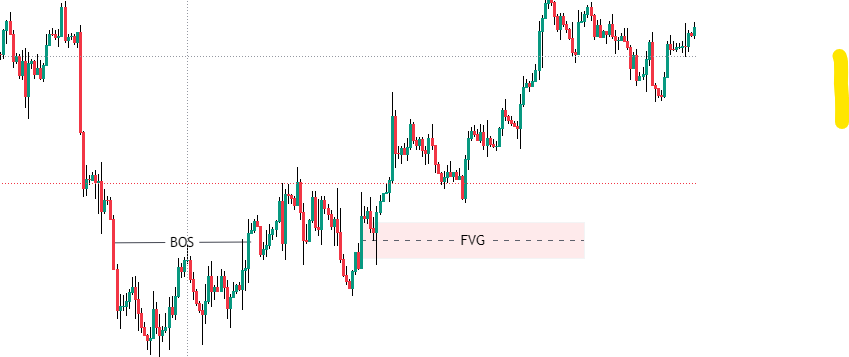

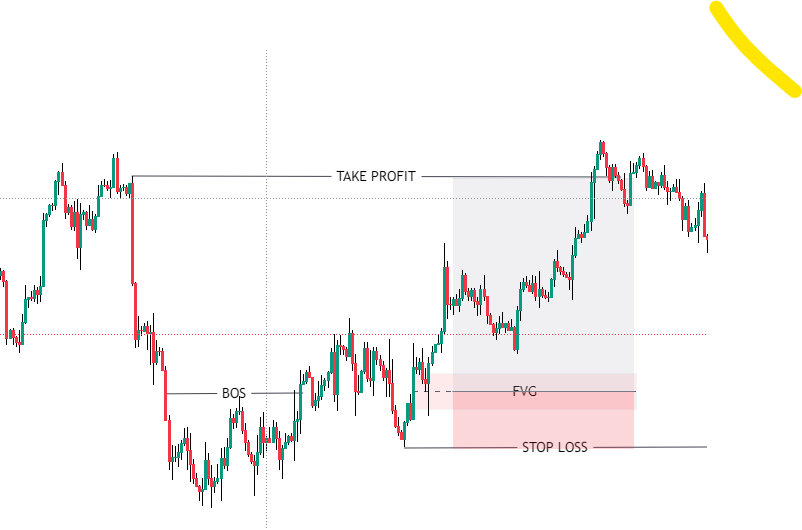

5. Wait for a Break of Structure (BOS) or Market Structure Shift (MSS)

At the POI on the lower timeframe, I wait for a Break of Structure (BOS) or a Market Structure Shift (MSS). These events indicate a change in the market’s direction and confirm the validity of the POI as a potential trade entry point.

6. Look for a Fair Value Gap (FVG)

Once a BOS/MSS has occurred, the next step is to identify a Fair Value Gap (FVG) and wait for the price to retrace and fill this imbalance. An FVG represents areas of inefficiency in the price action, often acting as strong zones where the price is likely to react.

7. Calculate Your Position Size

Before entering a trade, I calculate the position size using a position size calculator. This ensures that the trade is appropriately sized according to my risk management rules and account size, minimizing the risk of significant losses.

8. Place Your Stop Loss

The stop loss is placed at the nearest high or low relative to the entry point. This is a critical risk management step, as it protects the trading account from excessive losses if the trade moves against the intended direction.

9. Place Your Take Profit

Finally, the take profit is set at the nearest high or low, preferably aiming for a risk-to-reward (RR) ratio of 2:1. This means that for every unit of risk, the potential reward is two units, ensuring that profitable trades outweigh the losses over time.

Conclusion

By following this structured approach, my trading strategy aims to maximize the chances of passing the FundedNext $50,000 Challenge. It emphasizes clear trend identification, precise entry and exit points, and strict risk management to achieve consistent profitability.