Category: Prop Firms

-

Honest Review of the Funded Engineer Prop Firm – Pros & Cons

Honest analysis of the Funded Engineer Prop Firm, highlighting its benefits and drawbacks – an insightful funded engineer prop firm review for aspiring traders.

-

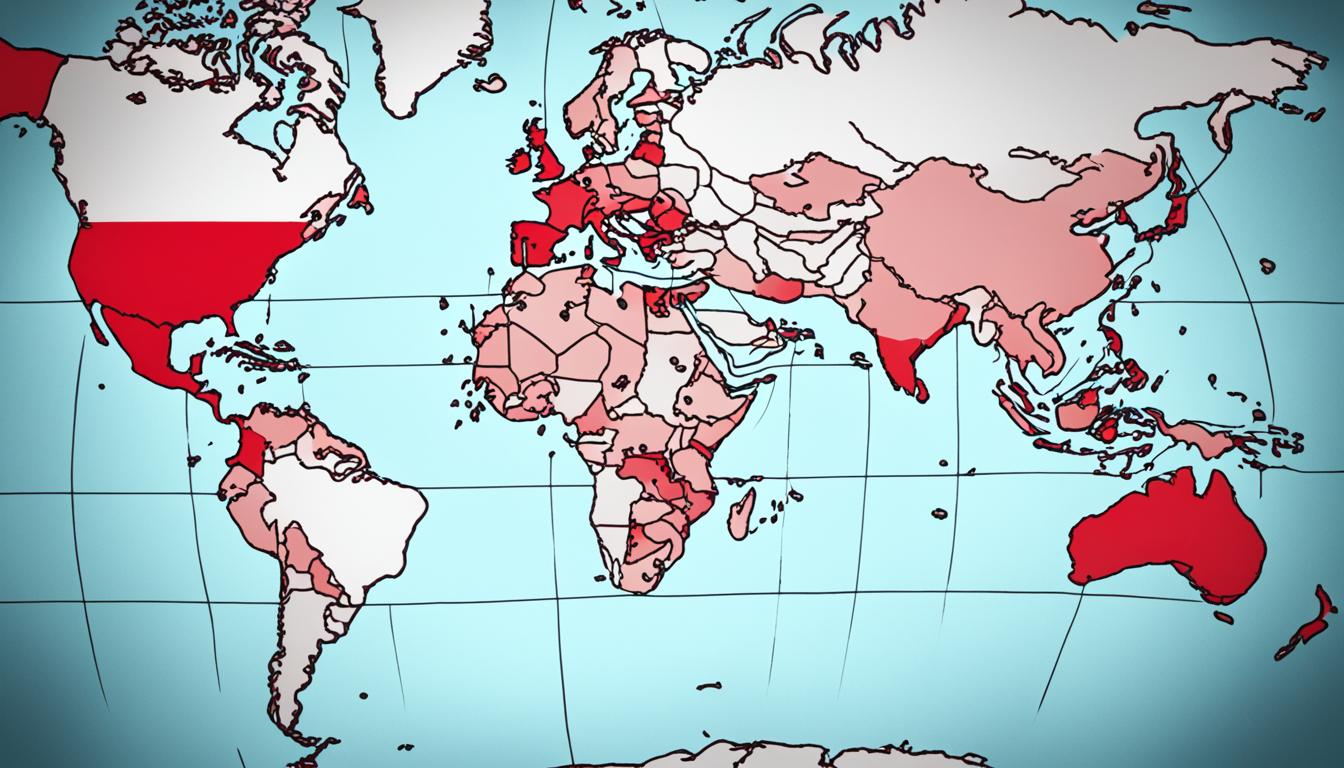

What Countries Are Banned From FTMO?

Discover which countries are restricted from accessing FTMO’s services, ensuring compliance with local regulations and maintaining a secure trading environment.

-

My Trading Strategy to Pass a FundedNext $50,000 Challenge

In this article, I will detail my trading strategy designed to pass the FundedNext $50,000 Challenge successfully. This strategy revolves around key market principles and precise execution steps to enhance the probability of profitable trades. 1. Identify a Trend Pair and Form Your Bias The first step in my strategy is to identify a clear…

-

Which Proprietary Trading Firms Use Exness?

In the dynamic world of proprietary trading, traders seek platforms that offer reliability, efficiency, and robust trading conditions. One platform that has gained attention is Exness, known for its competitive spreads, various instruments, and advanced trading tools. However, traders often wonder which prop firms incorporate Exness into their trading operations. Understanding Exness Exness is a…

-

Do Prop Firms Provide Real Accounts?

In the world of proprietary (prop) trading, a common question arises: Do prop firms give traders real accounts or demo accounts after passing the evaluation phase? The answer is nuanced and varies across firms. Understanding the dynamics of prop trading firms and their operational models can help clarify this question. Evaluation Phase: The First Step…

-

How Do People Fail to Make It to the Refund in FTMO?

How Do People Fail to Make It to the Refund in FTMO? FTMO, a prominent proprietary trading firm, allows traders to manage substantial capital after passing a rigorous evaluation process. While the allure of trading with FTMO’s funds and earning substantial profits is significant, many traders fail to make it to the refund stage. Understanding…

-

What is the Minimum Deposit for Futures Trading?

Futures trading, a financial mechanism allowing traders to buy or sell assets at a predetermined future date and price, has grown in popularity among investors looking to hedge risk or speculate on market movements. A common question for beginners is: “What is the minimum deposit for futures trading?” The answer varies based on several factors,…

-

Which Platform is Best for Commodity Trading?

Commodity trading has become increasingly popular among investors looking to diversify their portfolios and hedge against inflation. With the rise of online trading platforms, investors now have access to a wide array of tools and services to help them navigate the complexities of commodity markets. But with so many options available, choosing the best platform…

-

Reserve Bank of India Bans FTMO: A Mistake or Legal Necessity?

Why did the Reserve Bank of India Bans FTMO? In a significant move, the Reserve Bank of India (RBI) has included FTMO, a prominent prop trading firm, in its alert list, effectively banning its use within India. This decision has sparked a heated debate among traders and financial analysts: Was this a prudent step by…

-

What Are the Best Futures Trading Platforms?

Exploring the Top 6 Best Futures Trading Platforms for Traders In the fast-paced world of trading, futures markets offer immense opportunities for investors and traders alike. To navigate these markets effectively, having access to a reliable and feature-rich trading platform is crucial. The best futures trading platforms combine advanced technology, robust features, competitive pricing, and…