ffay.com.

-

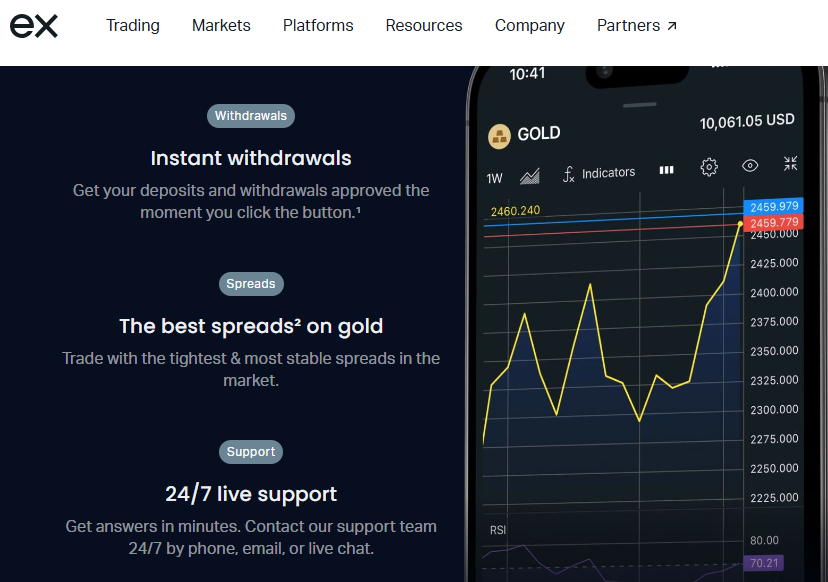

Is Exness a Prop Firm? Everything You Need to Know

Exness is one of the most recognised names in the online trading space. However, there’s growing confusion among beginner traders: Is Exness a prop firm or just a traditional forex broker? Understanding the difference between a proprietary trading firm and a broker like Exness is essential for making informed trading decisions. This article explores Exness’…

-

What Does a Negative Change in Net Working Capital Mean

Introduction Net working capital (NWC) is a crucial financial metric that reflects a company’s short-term liquidity and operational efficiency. Investors and business owners closely monitor changes in NWC to gauge a company’s financial health. But what does a negative change in net working capital mean? This article will explore the implications of a negative change,…

-

What Does a Negative Cash Flow to Stockholders Mean?

Introduction Cash flow analysis is essential for understanding a company’s financial health. One key metric is cash flow to stockholders, which measures how much cash a company distributes to its shareholders through dividends and share repurchases. But what happens when cash flow to stockholders is negative? Does it signal trouble, or can it be a…

-

What Does a Negative Cash Flow to Creditors Mean?

Introduction Understanding a company’s cash flow dynamics is crucial for assessing its financial health. One important metric in this context is cash flow to creditors, which indicates the net cash a company pays to its lenders. A negative cash flow to creditors can have significant implications, reflecting strategic financial decisions or potential financial distress. Understanding…

-

What Does a Negative Free Cash Flow Mean

Negative Free Cash Flow: Meaning, Causes, Examples & Impact on Valuation Understanding negative free cash flow (FCF) is essential for evaluating a company’s financial stability and growth potential. Free cash flow represents the cash a company generates after accounting for capital expenditures, and it serves as a key indicator of financial health. While positive FCF…

-

Different Types of Mutual Funds A Complete Guide

When it comes to investing, understanding the different types of mutual funds is crucial for making informed decisions that align with your financial goals. Mutual funds offer a wide range of investment options, each designed to cater to various risk tolerances, investment horizons, and asset classes. Whether you’re a conservative investor looking for stability or…

-

ETFs vs. Mutual Funds: A Comprehensive Comparison

Exchange-traded funds (ETFs) and mutual funds are two of the most popular investment vehicles available to investors. Both offer diversification and professional management, but they have key differences that can impact an investor’s strategy. This article provides a detailed comparison of ETFs and mutual funds to help investors make informed decisions. 1. Structure and Trading…

-

Active Non-Transparent ETFs vs. Active Transparent ETFs: A Comprehensive Comparison

Introduction Exchange-Traded Funds (ETFs) have evolved significantly, offering investors diversified access to various asset classes. Among active ETFs, two key structures have emerged: Active Transparent ETFs and Active Non-Transparent ETFs (ANTs). Understanding their differences is crucial for investors who seek active management but have preferences regarding portfolio disclosure and trading strategies. What Are Active Transparent…

-

How Many ETFs Are There in Australia?

Exchange-Traded Funds (ETFs) have gained significant popularity in Australia, providing investors with diversified and cost-effective access to various asset classes. The Australian ETF market has grown steadily over the past decade, with an increasing number of options available to investors. What Are ETFs? ETFs are investment funds that hold a collection of assets such as…

-

How Many ETFs Are There in the USA?

Exchange-Traded Funds (ETFs) have become a cornerstone of the U.S. investment landscape, offering investors diversified exposure to various asset classes with the flexibility of trading like individual stocks. Understanding the number and diversity of ETFs available can provide valuable insights for both novice and seasoned investors. What Is an ETF? An ETF is an investment…

Got any book recommendations?