Lux Trading Firm presents itself as a legitimate proprietary trading firm. It offers traders the opportunity to trade with the firm’s capital after successfully passing their evaluation programs. Reviews and community feedback suggest that Lux Trading Firm has a transparent business model and provides genuine opportunities for traders. However, as with any financial service, due diligence and thorough research are recommended before engaging with the firm.

Is Lux Trading Firm Regulated?

Lux Trading Firm is not directly regulated by any major financial regulatory bodies like the SEC (Securities and Exchange Commission) or the FCA (Financial Conduct Authority). This is typical for many proprietary trading firms, which operate under different business models compared to traditional brokerages. While the lack of direct regulation doesn’t necessarily indicate a scam, it does mean that traders should exercise additional caution and perform extensive research.

How Do I Know If My Prop Firm is Legit?

To determine if a proprietary trading firm is legitimate, consider the following steps:

- Check Reviews: Look at customer feedback on platforms like Trustpilot.

- Regulatory Status: Verify if the firm is registered or has any affiliations with recognized financial institutions.

- Transparency: Assess the firm’s transparency in terms of fees, rules, and payout structures.

- Reputation: Investigate the firm’s history, reputation in trading communities, and any notable partnerships.

- Contact Information: Ensure the firm has clear and accessible contact information, including a physical address.

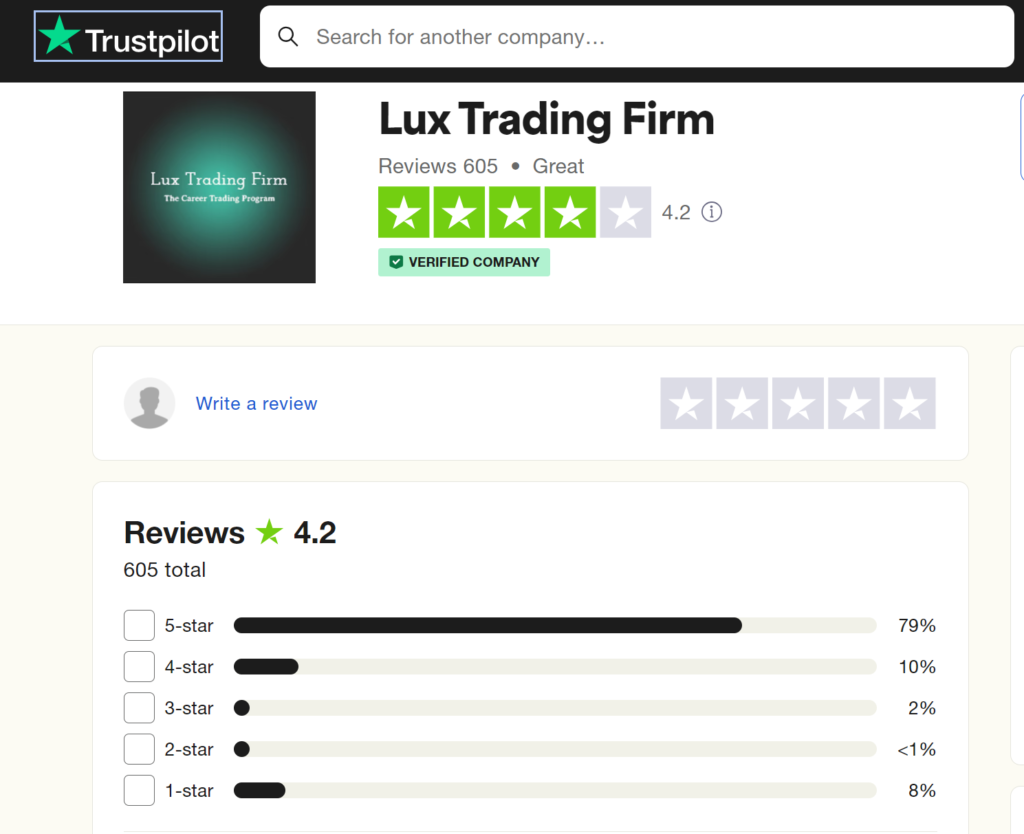

Lux Trading Firm Trustpilot Real Customer Reviews

Lux Trading Firm has mixed reviews on Trustpilot. Many users praise the firm for its supportive community, clear rules, and the opportunity to trade with significant capital. Positive reviews often highlight the firm’s responsive customer support and the structured evaluation process. However, some negative reviews mention challenges with the evaluation process and strict trading rules. It’s crucial to read a broad range of reviews to get a balanced view.

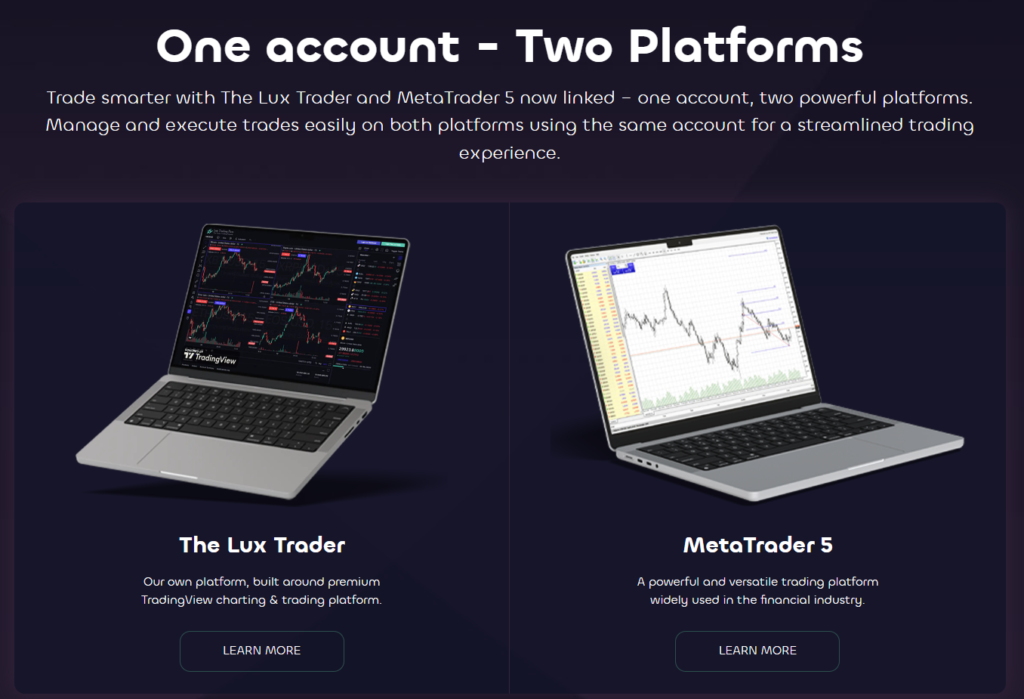

What Broker Does Lux Trading Firm Use?

Lux Trading Firm partners with various brokers to provide access to different financial markets. The specific brokers used can vary and are typically chosen for their reliability, execution speed, and access to diverse trading instruments. Traders should check directly with Lux Trading Firm for the most current broker partnerships.

Where is Lux Trading Firm Headquarters?

Lux Trading Firm is headquartered in Luxembourg, a known financial hub in Europe. The address and contact details are usually provided on their official website, allowing potential traders to verify their legitimacy and reach out for more information.

How Does Lux Trading Firm Work?

Lux Trading Firm operates by providing traders with capital to trade after they pass an evaluation process. The process typically involves:

- Evaluation Phase: Traders must demonstrate their trading skills by meeting specific profit targets and adhering to risk management rules.

- Funded Account: Successful traders are given a funded account with the firm’s capital.

- Profit Sharing: Traders keep a percentage of the profits they generate, with the remainder going to the firm.

- Scaling Plans: Many proprietary trading firms, including Lux Trading Firm, offer scaling plans that allow traders to manage larger amounts of capital as they prove their consistency and profitability.

What is the Maximum Drawdown on Lux Trading Firm?

Lux Trading Firm imposes a maximum drawdown limit to manage risk. This drawdown limit varies depending on the specific evaluation program or funded account level. Typically, the drawdown limit could range from 5% to 10%, meaning traders must manage their losses within this range to continue trading with the firm’s capital.

What is the Payout for Lux Trading Firm?

The payout structure at Lux Trading Firm usually involves a profit-sharing model where traders keep a significant percentage of the profits they generate. The exact payout ratio can vary but is often in the range of 50% to 80% for the trader, with the remaining percentage going to the firm. The specific details should be confirmed directly with Lux Trading Firm, as they may offer different payout structures for different account levels or trading programs.

Lux Trading Firm Free Trial

Lux Trading Firm may offer a free trial or demo account to prospective traders to familiarize them with the platform and trading conditions. This can be a valuable opportunity to understand the firm’s tools, resources, and evaluation process without financial risk. Interested traders should check the firm’s website or contact customer support for information on any available free trials.

Lux Trading Firm Rules PDF Download

Lux Trading Firm typically provides detailed rules and guidelines for their evaluation programs and funded accounts. These rules are crucial for traders to understand the conditions they must adhere to, such as profit targets, drawdown limits, and trading restrictions. Traders can usually download these rules in PDF format from the firm’s official website or request them from customer support.

Lux Trading Firm Payout

The payout process at Lux Trading Firm involves the transfer of profits earned by the trader. Payouts are usually made monthly, and the method can vary, including bank transfers, PayPal, or other payment methods specified by the firm. It’s important for traders to verify the payout schedule and methods to ensure they meet their financial planning needs.

Conclusion

Lux Trading Firm offers a legitimate opportunity for skilled traders to access significant capital and earn profits through a structured evaluation and funding process. While it is not directly regulated, the firm maintains transparency in its operations and has garnered positive reviews for its supportive community and clear trading rules. Prospective traders should carefully review the firm’s rules, perform due diligence, and consider using available resources such as free trials to assess suitability.