Exploring the Top 6 Best Futures Trading Platforms for Traders

In the fast-paced world of trading, futures markets offer immense opportunities for investors and traders alike. To navigate these markets effectively, having access to a reliable and feature-rich trading platform is crucial. The best futures trading platforms combine advanced technology, robust features, competitive pricing, and user-friendly interfaces to empower traders to make informed decisions and execute trades seamlessly. Let’s delve into some of the top futures trading platforms that are highly regarded in the industry. Also see: The 5 Best Futures Prop Trading Firms

Here are the Top 6 Best Futures Trading Platforms for Serious Traders

- Thinkorswim by TD Ameritrade:

Thinkorswim is a comprehensive trading platform known for its powerful charting tools, customizable interface, and advanced analysis capabilities. It offers a wide range of futures contracts across various asset classes, including commodities, currencies, and indices. Traders benefit from real-time data, technical indicators, and a vibrant community for sharing insights and strategies. - TradeStation:

TradeStation is renowned for its professional-grade trading tools and execution speed. The platform provides access to a diverse array of futures markets with customizable charts, backtesting capabilities, and a suite of technical analysis tools. TradeStation also offers low commissions and margin rates, making it appealing to active traders. - NinjaTrader:

NinjaTrader is a popular choice among futures traders due to its advanced charting capabilities, automated trading features, and extensive market analysis tools. It supports a wide range of futures brokers and provides access to real-time market data, historical data, and simulation trading for testing strategies. - Interactive Brokers:

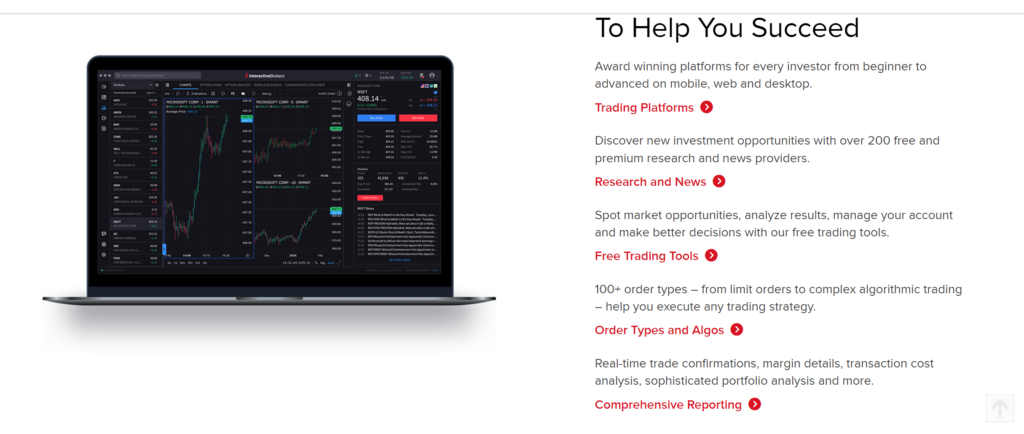

Interactive Brokers (IBKR) offers a powerful futures trading platform with direct market access, competitive pricing, and a vast selection of futures contracts. Traders can access global futures markets, leverage advanced order types, and benefit from low margin rates. IBKR’s platform also integrates with third-party analysis tools and APIs for algorithmic trading. - ETRADE Futures:

ETRADE provides a user-friendly platform for trading futures contracts alongside other asset classes. It offers intuitive charting tools, educational resources, and market research to assist traders in making informed decisions. E*TRADE’s futures platform is suitable for both beginner and experienced traders. - CQG:

CQG is a robust futures trading platform known for its advanced charting, order management, and risk analysis tools. It caters to professional traders and institutions, offering connectivity to multiple exchanges, real-time data, and customizable trading workflows. CQG’s platform is highly customizable and integrates with various trading systems and analytics providers.

When evaluating futures trading platforms, traders should consider factors such as trading fees, platform reliability, customer support, available markets, and compatibility with their trading strategies. It’s essential to choose a platform that aligns with your trading goals, risk tolerance, and technical requirements. Conducting thorough research, testing platform features, and seeking feedback from fellow traders can help in selecting the best futures trading platform for your needs.