How Do People Fail to Make It to the Refund in FTMO? FTMO, a prominent proprietary trading firm, allows traders to manage substantial capital after passing a rigorous evaluation process. While the allure of trading with FTMO’s funds and earning substantial profits is significant, many traders fail to make it to the refund stage. Understanding why this happens can provide valuable insights for those aspiring to succeed.

See also: Do Prop Firms Give You Real Money?

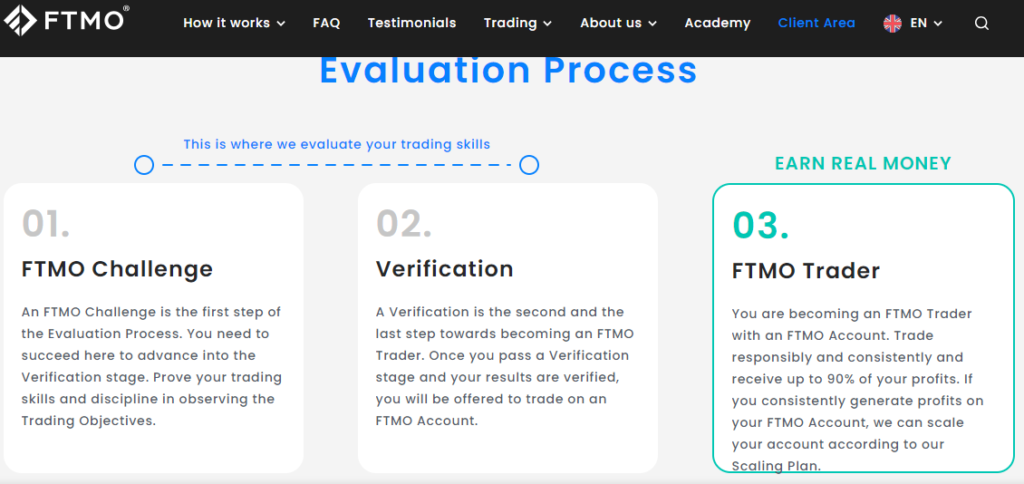

The FTMO Evaluation Process

FTMO’s evaluation process consists of two main stages: the Challenge and the Verification. These stages test the trader’s ability to manage risk and achieve consistent profitability. The key rules include:

- Daily Loss Limit: Traders must not lose more than 5% of the initial balance in a single day.

- Maximum Loss Limit: Traders must not lose over 10% of the initial balance overall.

- Profit Target: Traders must achieve a profit target, typically 10% for the Challenge and 5% for the Verification, within a specified period (usually 30 days for the Challenge and 60 days for the Verification).

Upon successfully completing these stages, traders receive a funded account and are eligible for a refund of their evaluation fees.

Common Reasons for Failure

Despite the seemingly straightforward rules, many traders fail to reach the refund stage. Here are some of the common reasons why:

- Overtrading:

- Overtrading is a common pitfall. Traders may attempt to achieve the profit target too quickly, leading to excessive trades and increased risk exposure. This behaviour often results in violating the daily or maximum loss limits.

- Lack of Risk Management:

- Effective risk management is crucial. Traders who do not use stop-loss orders, trade with excessive leverage, or fail to adhere to their risk management plan often face significant losses, breaching FTMO’s loss limits.

- Emotional Trading:

- Trading can be emotionally challenging. Fear, greed, and frustration can drive traders to make impulsive decisions, such as prematurely chasing losses or exiting profitable trades. Emotional trading undermines consistent performance.

- Inadequate Preparation:

- Some traders enter the FTMO evaluation without adequate preparation or understanding of the trading strategy they plan to use. The lack of a well-tested trading plan increases the likelihood of failure.

- Market Volatility:

- Markets can be unpredictable and volatile. Sudden market movements, especially during news events, can lead to significant losses if traders are not adequately prepared or fail to adapt their strategies.

- Complacency After Passing Evaluation:

- Passing the Challenge and Verification stages can give traders a false sense of security. Some may become complacent, deviating from their disciplined approach, which can lead to losses in the funded account phase.

Importance of Consistency and Discipline

Consistency and discipline are key to succeed in the FTMO evaluation and beyond. Here are some strategies to increase the chances of success:

- Adhere to Risk Management: Always use stop-loss orders and never risk more than a predetermined percentage of the account balance on a single trade.

- Stick to a Trading Plan: Before starting the evaluation, develop and test a robust trading plan. Stick to this plan and avoid making impulsive decisions.

- Manage Emotions: Develop psychological resilience to manage emotions. Consider techniques such as mindfulness or keeping a trading journal to maintain emotional control.

- Stay Informed: Keep up-to-date with market news and events that could impact trading. Avoid trading during highly volatile periods if not part of the strategy.

- Use Proper Tools: Utilize trading platforms that provide comprehensive risk management features. Avoid trading on mobile devices if it limits the ability to manage trades effectively.

Conclusion

Failing to make it to the refund stage in FTMO’s evaluation process is often due to overtrading, poor risk management, emotional decision-making, and inadequate preparation. By understanding these pitfalls and implementing disciplined trading strategies, traders can improve their chances of passing the evaluation and enjoying the benefits of trading with FTMO’s capital. For those genuinely committed to their trading careers, the journey through FTMO‘s rigorous process can be a valuable learning experience, fostering growth and resilience in the competitive world of trading.