Forex trading is always changing. Some countries can’t use top prop firm services. Traders are looking for new chances. But, they face more rules and decision barriers. This makes it harder to enter some markets.

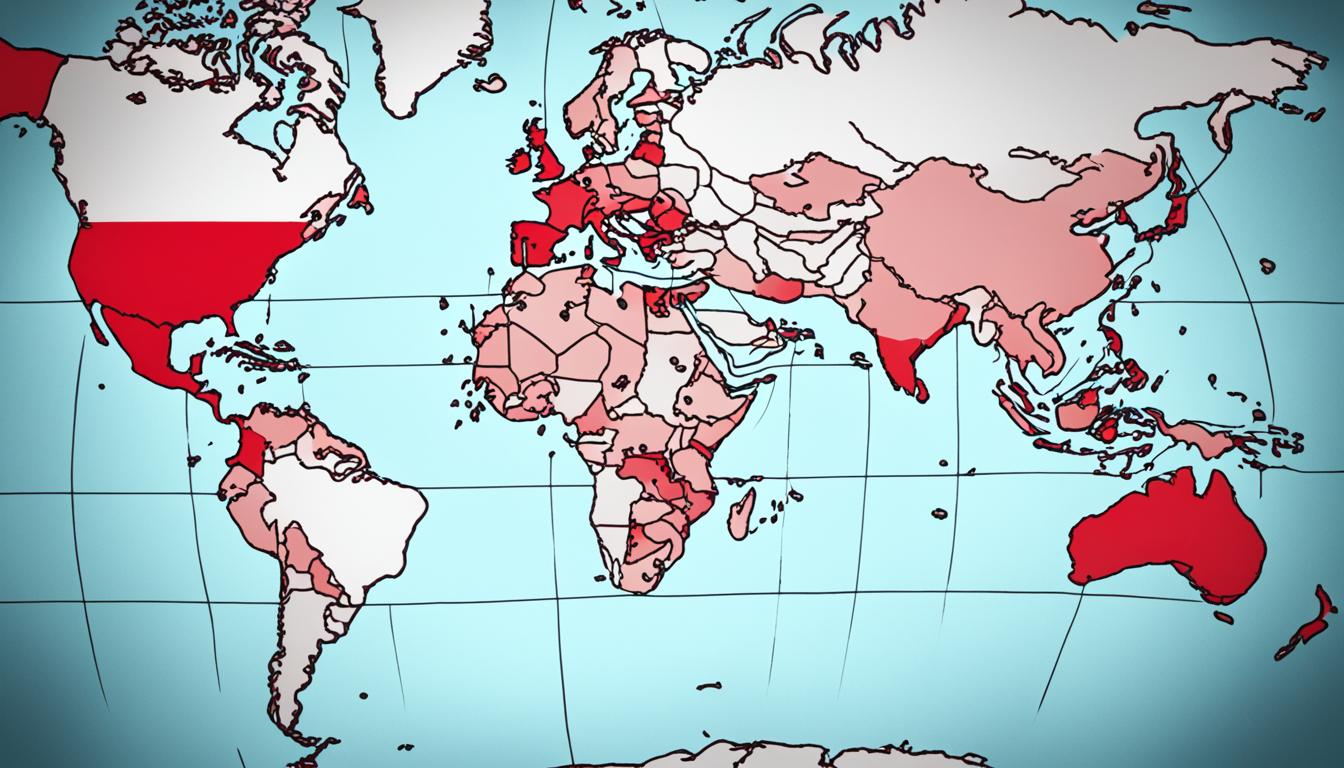

Here are the countries banned by FTMO. They are the US, Russia, India, North Korea, Belarus, Cuba, Indonesia, Venezuela, South Sudan, Sudan, Iran, Syria, and Myanmar. FTMO says it’s because of new rules and managing risk. This stops people from these countries from trading with them, known as FTMO-banned countries, FTMO-prohibited markets, and FTMO-restricted regions.

Even with these rules, FTMO wants to offer great service everywhere. They focus on following local laws. They work hard to make sure everyone trades safely and fairly.

Key Takeaways:

- FTMO has banned traders from accessing its services in the United States, Russia, India, North Korea, and several other countries.

- The prop firm has cited regulatory developments and risk management considerations as the primary reasons for these country-specific restrictions.

- FTMO remains dedicated to providing high-quality services to its global client base while ensuring compliance with local laws and regulations.

- Traders in FTMO-restricted regions may need to explore alternative prop firm options to continue their trading journeys.

- The prop firm industry is facing challenges due to evolving regulatory landscapes and industry changes, such as the impact of MetaTrader’s actions.

Introduction to FTMO Country Restrictions

1 The firm is fully dedicated to giving the best service to traders all over the world. It also puts a lot of effort into following every legal requirement closely.1

FTMO’s Commitment to Providing Top-Quality Services

FTMO focuses on providing great service to people globally. It aims to give traders excellent experiences. This effort is key to its mission, reaching out to traders from different parts of the world.1

The Importance of Regulatory Compliance

Following local and country-wide laws is vital for FTMO. This is because they want to create a safe place for trading.1 They use these country-specific rules to keep the trading environment secure. They also make sure their service is top-notch and looks after their clients’ best interests.1

Countries Banned from FTMO

FTMO prevents traders from certain countries from using its services.2 This includes the United States of America (US), the Russian Federation, India, and more. The main reasons for these restrictions are to follow local laws and for risk management.2

United States of America (US)

Certain US states like Louisiana and South Carolina can’t access FTMO.2

The Russian Federation

Traders from Russia can’t use FTMO’s services.2

India

India is on FTMO’s restricted list due to regulatory reasons.2

North Korea

North Korea is not allowed to use FTMO’s services, as the firm follows global rules strictly.2

The Republic of Belarus

FTMO doesn’t allow traders from Belarus to use its platform.2

Cuba

Cuban traders are also restricted by FTMO, in accordance with regulations.2

The Republic of Indonesia

Indonesia is one of the countries that can’t access FTMO’s services.2

Venezuela

Venezuelan traders can’t use FTMO’s platform.2

South Sudan

FTMO excludes traders from South Sudan for regulatory and risk reasons.2

Sudan

Traders from Sudan are also on the FTMO banned list.2

Iran

Iran is off-limits to FTMO as it upholds international sanctions and regulations.2

Syria

FTMO restricts traders from Syria due to regulatory policies.2

Myanmar

Myanmar traders can’t access FTMO’s platform.2

FTMO’s restrictions aim to ensure they follow all applicable laws and provide a safe trading space for their clients worldwide.23

FTMO’s Stance on Regulatory Developments

FTMO is taking an active role in dealing with FTMO regulatory compliance in the forex trading world. The prop firm is dedicated to adjusting its methods to meet new local and global rules.2 They are putting in place rules for each country and keeping an eye on changes in laws. Their aim is to keep a safe and legal trading space for customers. Plus, they want to find ways to serve more people around the world responsibly.2 The way FTMO handles FTMO’s response to industry changes and FTMO’s approach to regulatory updates shows they are committed. They want to be a leader in offering a dependable trading experience globally.

FTMO is being very active about FTMO regulatory compliance. They’ve set up rules that match local and global regulations to make their work correct and safe.2 This dedication to a secure and lawful trading space shines through in everything they do. They keep a close watch on the changing legal scene. This way, they can keep giving clients a reliable and safe way to trade. They also aim to reach more people worldwide, doing so in a careful manner.

Consequences for Traders in Banned Countries

FTMO’s restrictions affect traders from banned countries significantly. They lose access to FTMO’s services, like challenges and funded accounts.3 This change reduces trading chances and potential earnings. Yet, FTMO is working on ways to include all, following local laws.

The ban affects countries like Nigeria and Iran for legal reasons.3 Traders from these places can use other funding options in the market.3 They have a chance with different markets and platforms elsewhere, even if not with FTMO.

Places like Russia, Indonesia, and India face similar restrictions on FTMO.4 This means fewer chances for funded trading and market access.4 In India, traders should look for platforms that are open, trusted, and follow the law.4

It’s key for banned traders to grasp the impact of not using FTMO. Despite challenges, other firms and communities are available.3 They can still pursue prop trading through these alternative routes.

What Countries Are Banned From FTMO?

The following countries can’t access FTMO’s services: the US, Russia, India, North Korea, Belarus, Cuba, Indonesia, Venezuela, Sudan, Iran, Syria, and Myanmar. FTMO has specific reasons for this. They mention regulatory changes and risks in business. They aim to follow the law and keep offering great service everywhere.

Alternatives for Traders in Banned Countries

FTMO doesn’t let traders from some countries sign up. So, traders in these places might want to look at other prop trading firms.3 A few good ones are FunderPro, which gives you real money accounts and has a cool Tradelocker platform; The Funded Trader, which has big account sizes and often does special deals; and FundedNext, a cheaper firm that has lots of different challenges. These places let traders keep trading, with various account sizes and tools to suit different needs.

FunderPro: Live Capital Alternative

FunderPro is great because it gives traders a chance to use real money. With its Tradelocker, traders can show off their skills and maybe get funding. It’s a good choice for folks in places FTMO won’t accept anymore but still want to prop trade.2

The Funded Trader: Large Account Sizes

Another top option is The Funded Trader. It’s known for letting traders use big accounts. This is perfect for those who want to make as much money as they can, even if they can’t use FTMO anymore.2

FundedNext: Budget-Friendly Option

FundedNext is good for traders on a budget in FTMO-restricted countries. It has challenges that don’t cost a lot. This lets traders with different budgets and goals have a go at prop trading.2

Recent Regulatory Updates and Industry Changes

The prop firm sector is currently dealing with some big hurdles. Recent changes in rules and the industry have hit hard. An important event is MetaTrader taking away some firm’s licenses. This has led many prop firms to find other platforms to trade on.

MetaTrader’s Impact on Prop Firms

Firms with their own licenses, like The 5%ers, Alpha Capital Group, and FundedNext, are managing the change well. They can switch to new platforms more easily. But, lots of other prop firms are struggling. They are turning to places like DXTrade, CTrader, and MatchTrader. These new places might not offer the same good trading conditions and growth.

Adapting to Alternative Trading Platforms

This big change is making all prop firms have to be very flexible and strong. Only the most prepared will do well in this time of doubt. Prop firms moving to new platforms, the effects of MetaTrader’s changes, and the shifts in the prop trading market are changing how the future looks for prop trading.

Considerations for Relocating Abroad

With restrictions in specific countries, some traders are thinking about moving to keep trading.5But, there is a lot to think about before making this big move. Legal, financial, and practical considerations are key.

Legal and Financial Implications

Traders must check the laws and taxes of the new country.They need to know about local rules, how long they can stay, and trade limits for outsiders.Dealing with the money side is important too. This includes opening new accounts, dealing with different currencies, and understanding tax rules in both old and new countries.

Logistical Challenges

There are more hurdles than just the law and money.Setting up a new home, getting used to how things work, and making sure they can still trade are big tasks.5Also, some trading firms may not let you trade from certain countries. Planning ahead and getting everything ready is a must if you want to keep trading while moving.

The Future of Prop Firm Regulation

The prop firm industry is changing fast, making the future of its regulation a hot topic. There’s talk about creating global rules to standardize how prop firms work everywhere.6 Doing this could level the playing field and boost trust across the industry.

Potential for Global Regulatory Frameworks

Lately, the prop firm world has seen many challenges due to new rules and shifts in the industry.7 With things changing globally, we need rules that everyone follows.6 These could make everything clearer, manage risk better, and keep trading safer for all involved.

Importance of Industry Self-Regulation

In addition, the industry must regulate itself well. Firms that show they follow the rules, are ethical, and protect clients will do better. This way, they’ll earn respect from both regulators and traders.6 How firms monitor and adapt themselves will greatly influence future regulations.

The prop firm world is always evolving, keeping us curious about how it will be regulated.6 Moreover, we might see rules that are the same everywhere, improving how firms in all regions operate.6 Focusing on self-regulation is also crucial. Firms that stick to high standards and protect clients are more likely to succeed.6 They earn respect, which is good for them and the industry as a whole.6 How well the industry manages itself will play a big part in the future rules we see.

Conclusion

FTMO follows strict rules based on each country, showing they care about following laws and giving great service to people worldwide. The banned countries include the United States, Russia, and India. This choice comes from looking at changing rules and risks for business.3 Although this may affect traders in these places a lot, it shows how the whole trading world is focusing more on rules. Prop firms, like FTMO, must keep up with changing laws.

If you’re in a banned country, you might look for other prop firms. This makes the whole industry think about new ways to trade and follow global rules. The future for prop firms depends on them being able to check themselves, follow rules well, and come up with new ideas for traders all over the world. Firms that show they take rules, good business practices, and protecting clients seriously will likely do better in the long run. Both rule makers and traders see the worth in this kind of self-control.

To sum it up, the prop firm world is changing a lot because of new rules and the need to be good to customers everywhere.3 Overcoming these issues will need prop firms that can change, think of new ways, and put the traders first.

FAQ

What Countries Are Banned From FTMO?

Why Has FTMO Implemented These Country-Specific Restrictions?

How Does FTMO’s Commitment to Regulatory Compliance Impact Its Global Operations?

What Are the Consequences for Traders in the Banned Countries?

What Are the Top Alternatives for Traders in FTMO-Restricted Regions?

How Is the Prop Firm Industry Adapting to Recent Regulatory Updates and Industry Changes?

What Are the Considerations for Traders Relocating Abroad to Continue Prop Trading?

What Is the Future of Regulation in the Prop Firm Industry?

Source Links

- https://www.investopedia.com/articles/forex/11/why-trade-forex.asp

- https://proptraders.club/ftmo-banned-usa-clients-heres-our-top-5-alternatives-accepting-usa-traders/

- https://ffay.com/what-countries-are-banned-from-ftmo/

- https://ffay.com/why-is-ftmo-banned-in-india/

- https://forums.babypips.com/t/going-offshore-to-escape-the-cftc/35612/12802

- https://www.financemagnates.com/forex/exclusive-regulators-conducted-preliminary-reviews-on-potential-prop-trading-regulations/

- https://www.linkedin.com/pulse/prop-firms-united-states-best-us-wasee-schiesel-s72cf