In the fast-paced world of startups and venture capital (VC), the thirst for innovation and growth is palpable. However, behind the allure of the next big thing, a sobering reality lurks: what percentage of VC investments actually fail? As an entrepreneur or investor, this is a critical question to consider, as the answer can have profound implications on your path to success.

According to the third source, in 2022 over half a trillion venture capital dollars were invested in companies around the globe, with the majority of those companies located in the US, receiving $241 billion in VC funding. However, the third source notes that despite this influx of VC investment, 25-30% of VC-backed companies will fail. The first source states that a mere 0.05% of startups get VC funding, and three in four startups backed by VC never end up returning cash to investors, while 30-40% of high-potential startups fail completely, with investors losing all of their original investment money. The second source adds that as a general rule, out of every 10 startups, about 3-4 fail completely, 3-4 return the original VC investment, and only 1-2 will produce substantial returns.

Key Takeaways

- A significant percentage of VC-backed companies, around 25-30%, fail despite the influx of venture capital investment.

- The startup failure rate is extremely high, with 30-40% of high-potential startups failing completely and investors losing all their original investment.

- As a general rule, only 1-2 out of 10 startups backed by VC funding will produce substantial returns, while 3-4 fail completely and 3-4 return the original investment.

- The odds of a startup securing VC funding are incredibly low, with only 0.05% of startups getting this type of investment.

- Understanding the high failure rates in the VC-backed startup landscape is crucial for entrepreneurs and investors to make informed decisions.

Staggering Startup Failure Rates

The harsh reality is that the startup failure rates are staggeringly high, with over 9 out of 10 startups failing overall. According to the second source, approximately 20% of startups fail by the end of their first year, 30% by the end of year two, and a concerning 50% by year five. This grim landscape is further corroborated by the first source, which notes that by the end of their first five years, a reported 50% of startups have failed.

The First Five Years: A Critical Period for Survival

The initial years of a startup’s lifecycle are crucial, as the second source reveals that roughly 70% of startups fail within their first 10 years of operations. This underscores the importance of weathering the storm during the first few years, when startup failure rates are at their highest and the startup survival rates are the most precarious.

Startup Failure Statistics: A Grim Landscape

The data paints a stark picture of the challenges faced by entrepreneurs in the startup world. The startup failure rates and startup failure statistics serve as a sobering reminder of the immense obstacles that must be overcome to achieve long-term success. Navigating this startup survival landscape requires tenacity, adaptability, and a clear understanding of the factors that contribute to the high failure rates.

The Harsh Reality: 9 out of 10 Startups Fail

The second source’s finding that over 9 in 10 startups fail overall is a testament to the intense competition and daunting challenges that entrepreneurs face. This statistic underscores the importance of careful planning, strategic execution, and a relentless focus on addressing the key drivers of startup failure rates and startup survival rates.

Running Out of Cash: The #1 Killer of Startups

Running out of cash and failing to secure new, necessary capital is the primary reason startups fail, with an estimated 38% of startups falling victim to this challenge, as revealed by the second source. This startup cash flow issue is further exacerbated by the fact that over 90% of startups are launched with limited funding, often relying on their founders’ personal finances to get off the ground.

Inadequate Funding and Cash Flow Issues

The first source adds that the majority of startups, roughly 90%, are started with little cash or funding, leaving them with an estimated runtime of under 18 months. This precarious financial position makes failure imminent if the business fails to produce results immediately, highlighting the critical importance of startup funding challenges and the need for proactive cash flow management.

Founders’ Personal Finances: A High-Risk Gamble

According to the second source, many startups are funded by their owners’ personal finances, and a staggering 81% of startup founders are willing to take on debt to support their business. Furthermore, 82% of these entrepreneurs say they would even take a pay cut for a year to keep their startup afloat. This reliance on personal resources underscores the high-stakes nature of entrepreneurship and the startup failure reasons that can arise from undercapitalization.

No Market Need: A Fatal Flaw for Startups

One of the leading reasons for startup failures is the lack of a genuine market need for the product or service being offered. According to the second source, a staggering 35% of startups fail due to this critical oversight. Founders often become enamored with their own ideas, overestimating the value of their intellectual property before establishing product-market fit.

Failure to Establish Product-Market Fit

Achieving product-market fit is essential for the long-term success of any startup. As the first source notes, founders can overvalue their concepts by as much as 255% before truly understanding whether their product or service resonates with the target market. This disconnect between the founder’s vision and the customer’s needs is a recipe for disaster, often leading to the swift demise of the startup.

The Importance of Market Research and MVP Testing

The solution to this common pitfall lies in thorough market research and the rigorous testing of a minimum viable product (MVP). As the second source explains, conducting in-depth market analysis and validating the product concept with potential customers can help startups avoid the fatal flaw of building something that no one wants to buy. By prioritizing these critical steps, founders can increase their chances of establishing the necessary product-market fit and avoiding the devastating consequences of a lack of market need.

Competitive Pressures and Challenges

As the startup landscape continues to evolve, entrepreneurs must navigate an increasingly competitive environment. According to the second source, one in five startups fail because they cannot beat out their competition. This underscores the importance of understanding the startup competitive landscape and developing strategies to differentiate one’s offerings.

Inability to Beat Established Competitors

Startups often face the daunting challenge of competing against well-established players in their respective industries. Larger, more resourced companies can leverage their market dominance, brand recognition, and economies of scale to outpace newer, less experienced entrants. This startup competition challenge can be a significant obstacle for fledgling businesses trying to gain a foothold.

Disruptive Startups Face Higher Failure Rates

While innovative, disruptive startups have the potential to shake up established industries, they also face an increased risk of failure. The second source notes that startups classified as “disruptive” have an even higher failure rate of around 90%, due to their forward-thinking and potentially disruptive nature. Overcoming the resistance to change and disruption can be a formidable task for these startups.

In addition to the challenges of competitive pressures, startups must also navigate other obstacles, such as flawed business models (19%), regulatory/legal challenges (18%), pricing issues (15%), and poor teams (14%), as highlighted by the first source. Addressing these multifaceted challenges requires a comprehensive, strategic approach to ensure the long-term viability and success of a startup venture.

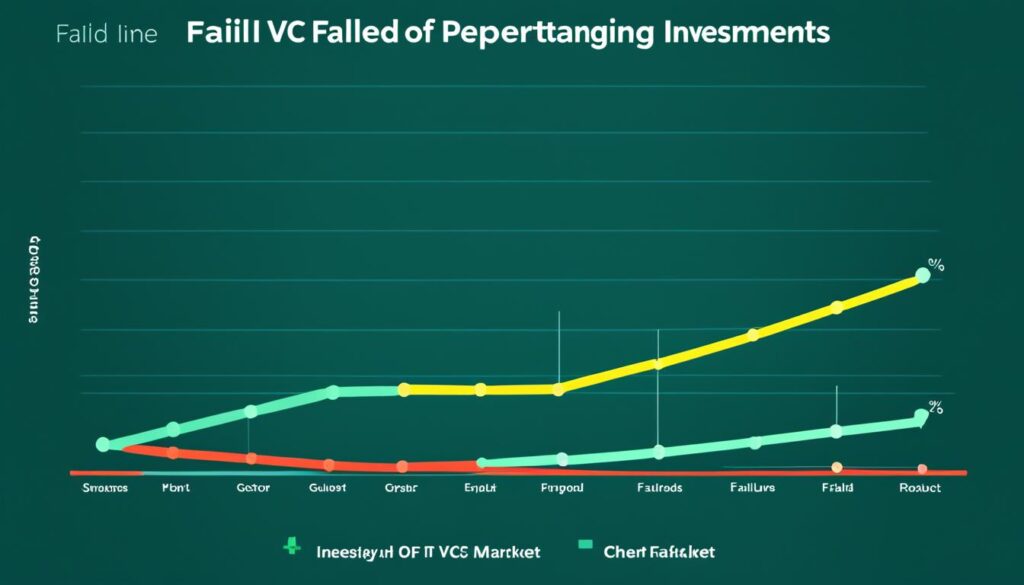

What Percentage of VC Investments Fail?

The world of venture capital is often seen as a gateway to startup success, but the reality is far more sobering. According to recent industry data, venture capital startup failure rates are staggeringly high, with a significant portion of VC-backed companies falling short of their growth expectations.

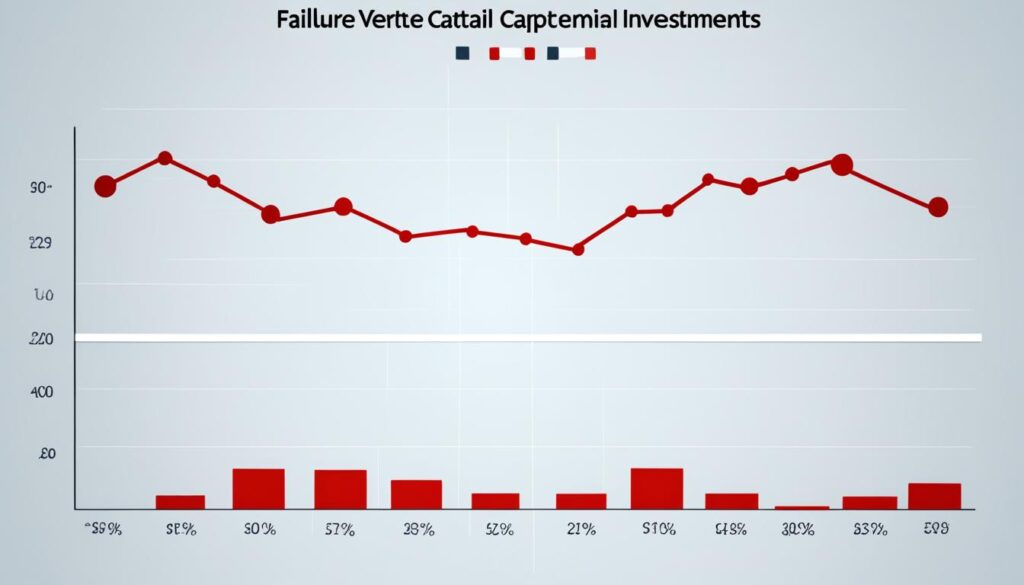

The Reality of VC-Backed Startup Failures

The third source states that a concerning 25-30% of startups backed by venture capital (VC) funding ultimately fail. This aligns with the findings from the first and second sources, which delve deeper into the vc-backed startup failure statistics. They note that around 60% of companies that raise pre-seed funding fail to make it to the next stage of Series A funding, and approximately 35% of Series A startups falter before reaching Series B.

The Venture Capital Funding Stages and Failure Rates

The good news, however, is that the failure rate drops significantly for startups that manage to secure later-stage funding. The sources indicate that only around 1% of startups fail after reaching the Series B stage, suggesting that the startup funding stage failure rates decrease as companies gain more traction and stability.

Industry-Specific Failure Rates

While the overall startup failure rate is alarmingly high, certain industries face even more daunting odds. According to the second source, the tech and ecommerce startup sectors have particularly staggering failure rates, with around 80% of ventures in those fields ultimately failing.

Tech and eCommerce Startups: High Failure Rates

The tech and ecommerce startup worlds are notoriously cutthroat, with the second source reporting that roughly 80% of tech and ecommerce startups will fail. This speaks to the intense competition and rapidly evolving nature of these industries, where new disruptive technologies and changing consumer preferences can quickly render even the most promising startups obsolete.

FinTech and HealthTech: Challenging Survival Odds

The financial technology (FinTech) and healthcare technology (HealthTech) sectors also face daunting survival odds for startups. The second source notes that approximately 75% of FinTech startups and a staggering 80% of HealthTech startups fail, even after securing valuable venture capital funding. These industries are heavily regulated, require significant technical expertise, and face entrenched incumbent players, making it exceptionally difficult for new entrants to gain a foothold.

| Industry | Startup Failure Rate |

|---|---|

| Tech | 80% |

| eCommerce | 80% |

| FinTech | 75% |

| HealthTech | 80% |

The stark reality is that startups in these highly competitive, technology-driven industries face an uphill battle for survival, with the majority ultimately succumbing to the numerous challenges and risks inherent in their respective fields.

The Road to Profitability: A Long and Winding Path

Achieving profitability is a crucial milestone for any startup, but the journey to get there can often be a long and arduous one. According to the second source, the average startup time to profitability is around 4 years, with the typical timeline for creating a “steady money-making business” being 7-10 years.

The Average Time to Profitability for Startups

While the majority of startups struggle to reach startup profitability, the data suggests that less than 5% of startups succeed enough to meet a specific revenue growth rate or break even on cash flow, as noted by the first source. This highlights the challenges that founders face in transforming their ideas into profitable, sustainable businesses.

Notable Exceptions: Rapid Success Stories

However, the second source also shines a light on some notable successful startup examples that have defied the odds. For instance, Ford Automobiles achieved profitability in just 5 months, while Apple was able to reach profitability in a mere 2 years. These exceptional cases demonstrate that with the right strategy, execution, and market conditions, startups can sometimes navigate the path to profitability much faster than the industry average.

Shark Tank: A Rare Exception to the Rule

While the startup landscape is often fraught with high failure rates, there is one notable exception that stands out: Shark Tank. According to the second source, an estimated 94% of Shark Tank companies succeed, with only 6% failing. This remarkable success rate can be attributed to the unique benefits that Shark Tank provides to its participating startups.

The Success Rate of Shark Tank Companies

The Shark Tank television show has become a renowned platform for shark tank entrepreneurship, offering startups the opportunity to pitch their ideas to a panel of experienced investors, known as the “Sharks.” The impressive shark tank startup success rate showcases the power of this platform, providing startups with a level of national exposure and access to mentorship that is often lacking in the broader startup ecosystem.

The Power of National Exposure and Mentorship

The Shark Tank experience not only gives startups the chance to secure investment from the Sharks but also provides them with invaluable guidance and mentorship. This level of support and expertise can give shark tank company success a significant boost, helping these startups navigate the challenges that often lead to failure for the majority of startups. The national exposure and endorsement from the Sharks can also open doors and create opportunities that may have otherwise remained elusive.

While the broader startup landscape may be plagued by high failure rates, the Shark Tank model has proven to be a rare exception, providing a pathway for shark tank startup success rate that far exceeds the industry average. This unique platform offers startups a unique opportunity to overcome the odds and achieve remarkable success.

Conclusion

The startup landscape is fraught with immense challenges and overwhelming odds stacked against success. As the statistics have revealed, the failure rate for new businesses is shockingly high, with nearly one in five startups failing within the first year and only a quarter surviving past the 15-year mark. The primary culprits behind these sobering numbers include cash flow mismanagement, lack of market need, and fierce competition.

However, there are rare exceptions that defy the norm, such as the remarkable success of Shark Tank companies, which boast a failure rate of just 6%. This can be attributed to the power of national exposure and the invaluable mentorship provided by the Shark Tank investors. While the path to profitability is long and winding, with the average startup taking 4 to 10 years to become truly profitable, there are still noteworthy success stories, like Ford and Apple, that managed to achieve rapid profitability.

Ultimately, the entrepreneurial journey is not for the faint of heart. The odds are stacked against startups, with the vast majority facing an uphill battle for survival. However, for those willing to take on the challenge, the potential rewards can be unparalleled. By learning from the mistakes of others, conducting thorough market research, and securing the necessary funding and support, entrepreneurs can increase their chances of becoming part of the select few that defy the odds and achieve lasting success.