Venture capital is a form of private equity investing that serves as a powerful catalyst for innovation and growth. By backing young, promising companies, VC firms seek to profit from new technologies and business models that will generate rapid growth. It’s important for venture capitalists and their investors, such as pensions and endowments, to be able to gauge the performance of VC investments. An internal rate of return, or IRR, is one way of measuring the success of a venture capital fund. At its most basic, the IRR is the annualized return that a VC fund generates, or expects to generate over the duration of the investment, typically eight years or so.

Unlike many other performance metrics, IRR factors in the ‘time value’ of money. The higher the IRR, the better an investment is performing (or expected to perform). Calculating expected returns on a venture investment is more complicated than predicting how much your 401(k) will grow next year. IRR shows the annualized percent return an investor’s portfolio company or fund has earned (or expects to earn) over the life of an investment.

When it comes to venture capital, a good Internal Rate of Return (IRR) is important. IRR provides investors with insight into their potential return on investments. In essence, this means that when calculating IRR, you are taking into account both positive and negative cash flow streams in order to determine what return on investment can be expected over time if those same streams continue indefinitely into the future.

Key Takeaways

- Venture capital is a form of private equity investing that aims to profit from new technologies and business models.

- IRR (Internal Rate of Return) is a key metric used to measure the success of a venture capital fund.

- IRR factors in the time value of money, and a higher IRR indicates better investment performance.

- Calculating expected returns on venture investments is more complex than traditional investments.

- IRR provides investors with insight into their potential return on venture capital investments.

Understanding Internal Rate of Return (IRR)

The internal rate of return (IRR) is a widely used metric in the world of venture capital investing. To understand how to calculate IRR, we must first grasp the concept of net present value (NPV). NPV estimates the future value of an investment and translates it into today’s dollars. IRR, on the other hand, is the annual rate of return an investment must generate to make NPV equal to 0.

Calculating IRR

The process of calculating IRR involves several steps. First, you must gather relevant data such as cash flows, investments, and any other necessary information. Next, you need to calculate the NPV by subtracting the initial cost from the total return at a specific point in time and multiplying this number by one plus the desired rate of return over that period. Finally, IRR is calculated by taking the difference between the current value of an investment and its original beginning value, dividing that number by the original value, and multiplying it by 100.

Advantages & Disadvantages of Using the Internal Rate of Return Methodology

The advantages of using IRR as a performance metric include its ability to accurately compare different projects regardless of their size or duration, as well as its usefulness in assessing risk versus reward scenarios before committing funds. However, there are also some drawbacks associated with this method, such as its inability to factor in taxes due upon sale, liquidation, and external factors like changes in government regulations.

Historical Average Returns for VC Funds

The historical average return for venture capital funds has been around 20%. This means that investors in these funds have seen a 20% return on their money over time. However, this number can vary depending on the type of fund and its strategy, with some funds focusing more heavily on early-stage companies while others may invest in later-stage companies with higher valuations but lower risk profiles.

According to research by Industry Ventures on historical venture capital returns, general partners (GPs) should target an internal rate of return (IRR) of at least 30% when investing at the seed stage. Industry Ventures suggests targeting an IRR of 20% for later stages, given that those investments are generally less risky.

The historical average return for venture capital funds has been around 20%. This can vary depending on the type of fund and its strategy, with some funds focusing more on early-stage companies while others invest in later-stage companies with higher valuations but lower risk profiles.

Risk-Adjusted Returns for VC Funds

Risk-adjusted returns are another crucial factor when evaluating venture capital investments. These returns take into account not only the potential upside but also the downside risks associated with investing in a particular company or sector. Generally speaking, higher-risk investments tend to offer higher returns, while lower-risk investments tend to offer lower returns but also less volatility and uncertainty over time.

According to an AngelList analysis, funds that invest faster tend to have lower IRRs but higher TVPIs than their slower-investing peers—creating further ambiguity for investors. This highlights the importance of considering both IRR and TVPI when evaluating fund performance, as they can provide different insights.

Risk-adjusted returns are an important consideration when evaluating venture capital investments, as they take into account both the potential upside and downside risks. Higher-risk investments tend to offer higher returns, while lower-risk investments typically have lower returns but less volatility and uncertainty.

Expected Returns for Different Types of Investments

The expected returns for different types of investments can vary significantly. Angel investors, for example, typically expect higher rates of return compared to traditional equity investors, due to the increased risk associated with early-stage startups. Private equity firms, on the other hand, often target mid to late-stage businesses, which generally require less upfront capital but have more established business models, providing greater stability.

According to research by Industry Ventures, general partners (GPs) should target an internal rate of return (IRR) of at least 30% when investing at the seed stage, and an IRR of 20% for later stages, given that those investments are generally less risky.

The underlying fundamentals, such as size, stage of development, and industry sector, should also be factored in when considering expected returns for different types of investments. This helps investors understand the risk-reward profile of various investment opportunities and make more informed decisions about where to allocate their capital.

| Investment Type | Expected IRR Range |

|---|---|

| Angel Investments | 30% or higher |

| Seed-stage Venture Capital | 30%+ |

| Later-stage Venture Capital | 20%+ |

| Private Equity (Mid-to-Late Stage) | 20%+ |

This table illustrates the expected returns for different types of investments, highlighting the higher risk-return profile of early-stage venture capital investments compared to later-stage and private equity deals. Investors should carefully consider these benchmarks when evaluating potential investment opportunities.

Strategies to Maximize Your Investments

To maximize the internal rate of return (IRR) on your venture capital investments, it’s important to employ a well-rounded strategy that addresses key factors such as diversification, early-stage investing, and sustainable competitive advantage.

Diversification Strategies for Higher Returns

Diversifying your investments across different sectors is one of the most effective ways to maximize venture capital investments. By investing in a variety of industries, you can reduce overall risk while still achieving higher returns. This approach helps create a balanced portfolio that can weather market fluctuations and capitalize on opportunities in different areas of the economy.

Investing in Early Stage Companies with High Growth Potential

Investing in early-stage companies can be a risky proposition, but it also offers the potential for high rewards. These types of investments often have significant growth potential due to their low overhead costs and lack of established competition. While the risks are higher, savvy investors can potentially achieve outsized returns by identifying promising early stage companies with the right combination of innovative products, talented teams, and scalable business models.

Look for Sustainable Competitive Advantage

When evaluating potential venture capital investments, it’s important to look for companies that possess a sustainable competitive advantage. This means the company has something unique about it that sets it apart from competitors, allowing it to remain profitable over time despite changes within the industry or marketplace. Identifying these types of companies with sustainable competitive advantages is an effective way to maximize the internal rate of return (IRR) of a venture capital portfolio.

early stage companies

early stage companies

, and seeking out businesses with

sustainable competitive advantages

, investors can position their venture capital portfolios for

maximized returns

and long-term success.

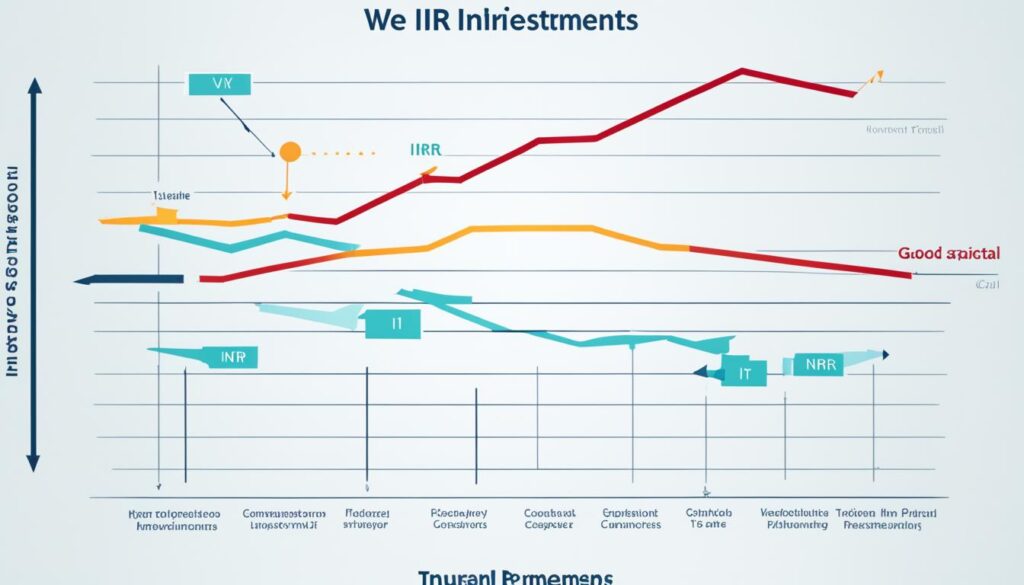

What is a good IRR for venture capital?

When it comes to what is a good IRR for venture capital, there is no single definitive answer, as it can vary depending on a number of factors. However, industry research suggests that venture capital funds should generally target an internal rate of return (IRR) of at least 20-30% to compensate for the high risk involved. Funds investing at the seed stage may aim for the higher end of that range, while later-stage investments may target the lower end.

According to research by Industry Ventures, general partners (GPs) should target an IRR of at least 30% when investing at the seed stage, and an IRR of 20% for later stages, given that those investments are generally less risky. This highlights the higher risk-return profile of early-stage venture capital investments compared to later-stage deals.

Interestingly, the historical average return for venture capital funds has been around 20%, though this can vary widely depending on the type of fund and its investment strategy. Some funds may focus on higher-risk, early-stage investments with the potential for greater returns, while others may target lower-risk, later-stage deals with more modest expected IRRs.

Key Factors Influencing a Good IRR

When it comes to venture capital investments, several key factors can influence what constitutes a “good” internal rate of return (IRR). The investment stage, industry sector, and risk tolerance are all critical considerations that can impact the expected IRR for a VC fund.

Investment Stage

Funds investing in earlier-stage, higher-risk companies may target IRRs in the 30% range to compensate for the increased volatility. These early-stage deals, such as seed-stage investments, typically carry a higher risk profile but also offer the potential for greater returns. On the other hand, later-stage investments generally have a lower risk tolerance, with venture capital firms often aiming for a more modest 20% IRR target.

Industry Sector

The specific industry and growth potential of a sector can also influence the expected IRR for a venture capital investment. High-growth, technology-focused startups may potentially command higher returns than investments in more mature, slower-growing industries. The industry’s overall growth trajectory and competitive landscape are important factors to consider when evaluating the likely IRR of a VC investment.

Risk Tolerance

A fund’s risk tolerance is a critical factor in determining a good IRR target. Venture capital firms that are willing to take on higher-risk, earlier-stage investments may seek IRRs in the 30% range to compensate for the increased volatility. Conversely, funds with a lower risk appetite, typically investing in later-stage companies, may be satisfied with a 20% IRR target, as these deals generally carry less risk.

Benchmarking IRR for VC Investments

Benchmarking the internal rate of return (IRR) for venture capital investments is important for evaluating performance and comparing funds across the industry. Research suggests that top-performing VC funds typically target IRRs in the 25-30% range, though actual returns can vary significantly based on factors like investment stage, industry sector, and risk profile. Investors should consider IRR alongside other metrics like TVPI when assessing VC fund performance to get a more complete picture.

According to the information provided, venture capital firms use IRR for many reasons, including to help determine whether it would be worthwhile to make an investment in a particular startup and to entice institutions to invest in new funds that the VC firms launch. Institutional investors and their consultants also weigh VC firm forecasts of benchmarking IRR for venture capital investments when deciding whether to invest in a new fund, and consider the past IRRs of older funds as well.

Benchmarking the IRR of a venture capital investment is important for evaluating its performance relative to other funds and asset classes. Industry research suggests that top-performing VC funds typically target IRRs in the 25-30% range, though the actual returns can vary widely. Factors like investment stage, industry sector, and risk profile all play a role in determining a “good” IRR benchmark. Investors should also consider other metrics like TVPI when assessing VC fund performance, as IRR alone may not tell the full story.

Maximizing IRR Through Portfolio Management

Crafting a well-diversified venture capital portfolio is a crucial strategy for maximizing IRR through portfolio management. By diversifying investments across sectors, investors can reduce overall risk while still targeting high-growth opportunities that have the potential to deliver exceptional returns.

Diversification Across Sectors

Spreading capital across a variety of industries is an effective way to diversify a venture capital portfolio. This approach helps mitigate the impact of sector-specific volatility, ensuring that the portfolio’s performance is not overly reliant on the success or failure of any single industry. By allocating funds to companies operating in different markets, investors can maximize their chances of achieving consistent, positive returns over the long term.

Balancing Risk and Return

Venture capital investments inherently involve a trade-off between risk and return. Higher-risk, early-stage deals have the potential to generate outsized IRRs, but they also come with greater volatility and uncertainty. Conversely, lower-risk, later-stage investments may offer more stability and predictable returns, but with a lower upside potential. Carefully managing this balance is key to optimizing the IRR of a VC investment portfolio. Investors must weigh the risks and rewards associated with each opportunity to construct a diversified, high-performing portfolio.

Tax Implications and IRR

When evaluating the internal rate of return (IRR) for venture capital investments, it’s important to consider the tax implications that can impact the overall performance of these investments. However, the sources provided in this article do not delve into the specifics of how taxes might affect the calculation and interpretation of IRR for venture capital funds.

The article notes that one of the drawbacks of using the IRR methodology is its inability to factor in taxes due upon the sale or liquidation of investments. This is a significant limitation, as taxes can significantly reduce the net returns an investor realizes from their venture capital portfolio. Additionally, the tax treatment of various investment structures, such as carried interest, can also influence the IRR calculation and overall investment returns.

While the article does not provide detailed information on the tax implications and IRR for venture capital investments, this is an important consideration for investors seeking to maximize their returns. Understanding the tax-related factors that can impact IRR, such as capital gains rates, loss treatment, and deductions, can help venture capital investors make more informed decisions and optimize their investment strategies accordingly.

Evaluating Past Performance of VC Funds

When it comes to investing in venture capital funds, evaluating past performance is crucial for assessing a fund’s future potential. Institutional investors, along with their consultants, closely examine VC firm forecasts of internal rate of return (IRR) when deciding whether to invest in a new fund. They also consider the past IRRs of older funds, as this historical data provides valuable insights into a firm’s ability to deliver strong returns over time.

The internal rate of return (IRR) is a key metric that allows investors to make standard comparisons across asset classes and funds of different vintage years. This feature enables them to evaluate the relative performance of VC funds over time, regardless of when the investments were made. By benchmarking the IRR for venture capital investments, investors can assess a fund’s track record and compare it to industry standards, helping them make more informed decisions about where to allocate their capital.

Alongside IRR, investors should also consider a fund’s past track record of total value to paid-in (TVPI) ratio, another important metric for evaluating the past performance of venture capital funds. By analyzing a combination of IRR and TVPI, investors can gain a more comprehensive understanding of a fund’s historical returns and the potential for future success.

Conclusion

Understanding the concept of Internal Rate of Return (IRR) and what constitutes a good IRR for venture capital investments can help investors make informed decisions. A good IRR should be determined based on venture capitalists’ risk tolerance, expected returns, and other factors. By utilizing strategies such as diversifying investments, investing in high-growth companies, and leveraging tax benefits, investors can maximize their VC investment’s IRR and increase their chances of achieving positive returns. Ultimately, a good IRR for venture capital depends on each individual investor’s goals and objectives.

While IRR is a valuable metric for analyzing the return prospects of an investment, it shouldn’t be the only valuation method. Many venture capital firms report both IRR and TVPI (Total Value to Paid-In) to provide a more holistic understanding of their investment performance. AngelList has developed a calculator that factors in both IRR and TVPI, enabling investors to assess fund performance in an apples-to-apples way.

In conclusion, determining what constitutes a “good” IRR for venture capital investments can be a complex endeavor, as it depends on a variety of factors, including risk tolerance, expected returns, and investment stage. By understanding the nuances of this metric and employing effective strategies to maximize IRR, investors can make more informed decisions and potentially achieve higher returns on their venture capital investments.