Tag: Startup funding

-

The Future of Venture Capital: Opportunities Ahead

The future of venture capital is ripe with possibilities as innovative startups disrupt industries and VC firms adapt to evolving market dynamics.

-

How Do VCs Evaluate E-Commerce Startups for Investment?

How do VCs evaluate e-commerce startups for investment? Discover the key factors venture capitalists consider when assessing the potential of online retail businesses.

-

How to Attract Venture Capitalists to a Non-Tech Startup

Attract venture capitalists to your non-tech startup by crafting a compelling business plan, demonstrating profitability potential, and leveraging your entrepreneurial expertise.

-

How Is Venture Capital Different in Tech vs Healthcare?

How is venture capital different in tech vs healthcare? Explore the key differences in risk tolerance, return expectations, and regulatory hurdles for VCs in these industries.

-

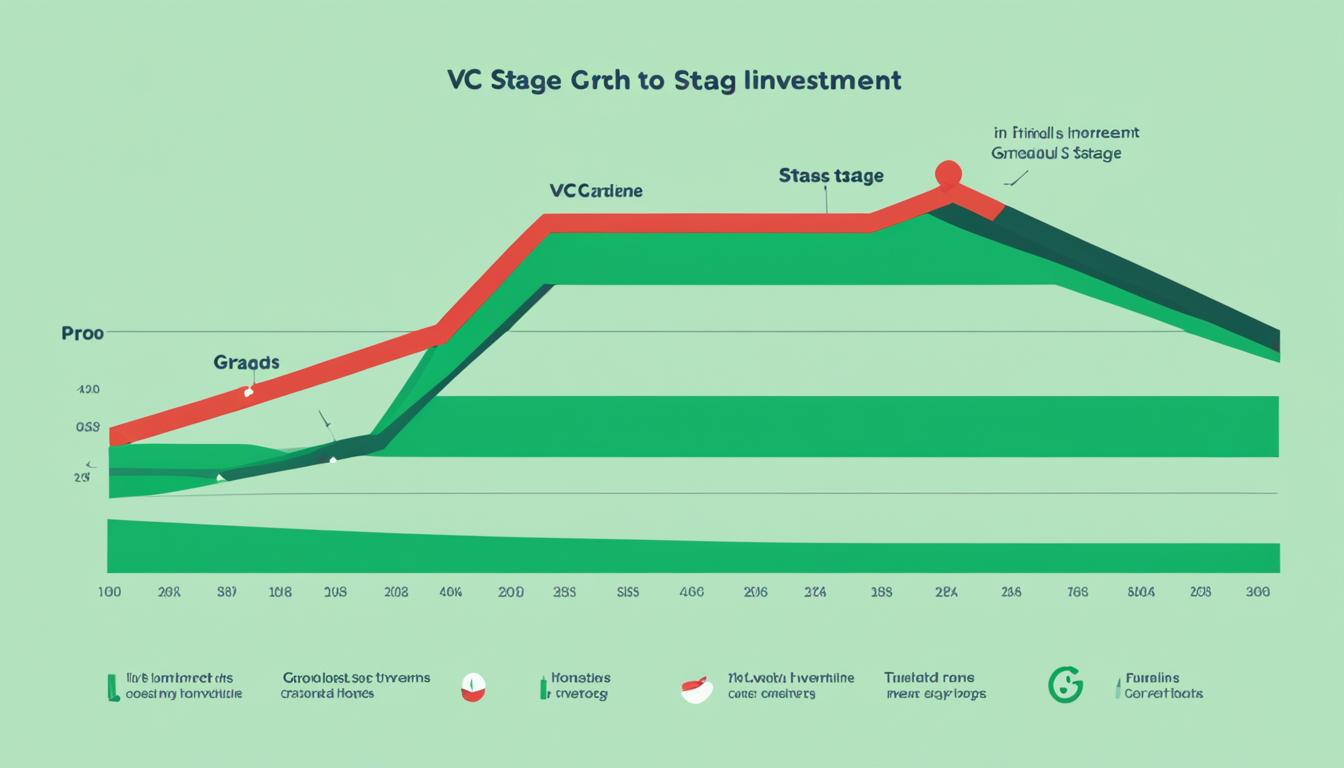

What is a typical VC investment timeline? A guide

A typical VC investment timeline involves sourcing deals, conducting due diligence, negotiating terms, and exiting investments over several years.

-

What’s the Difference Between Angel Investors and VCs?

Discover the key differences between angel investors and venture capitalists, two major funding sources for startups. Learn how they operate and invest.

-

How to Find the Right Venture Capital Firm for Your Startup

Discover the crucial steps to identify the ideal venture capital firm that aligns with your startup’s vision and fuels your entrepreneurial journey towards success.

-

How Much Equity Should I Give to Venture Capitalists?

How much equity should I give to venture capitalists? Discover guidelines on the optimal equity split between founders and VCs, ensuring fair value for investment.

-

Best Practices for Pitching to VCs: Tips for Success

Elevate your pitch with proven best practices for approaching VCs: perfect your story, research investors, tailor your deck, and nail the delivery for successful fundraising.

-

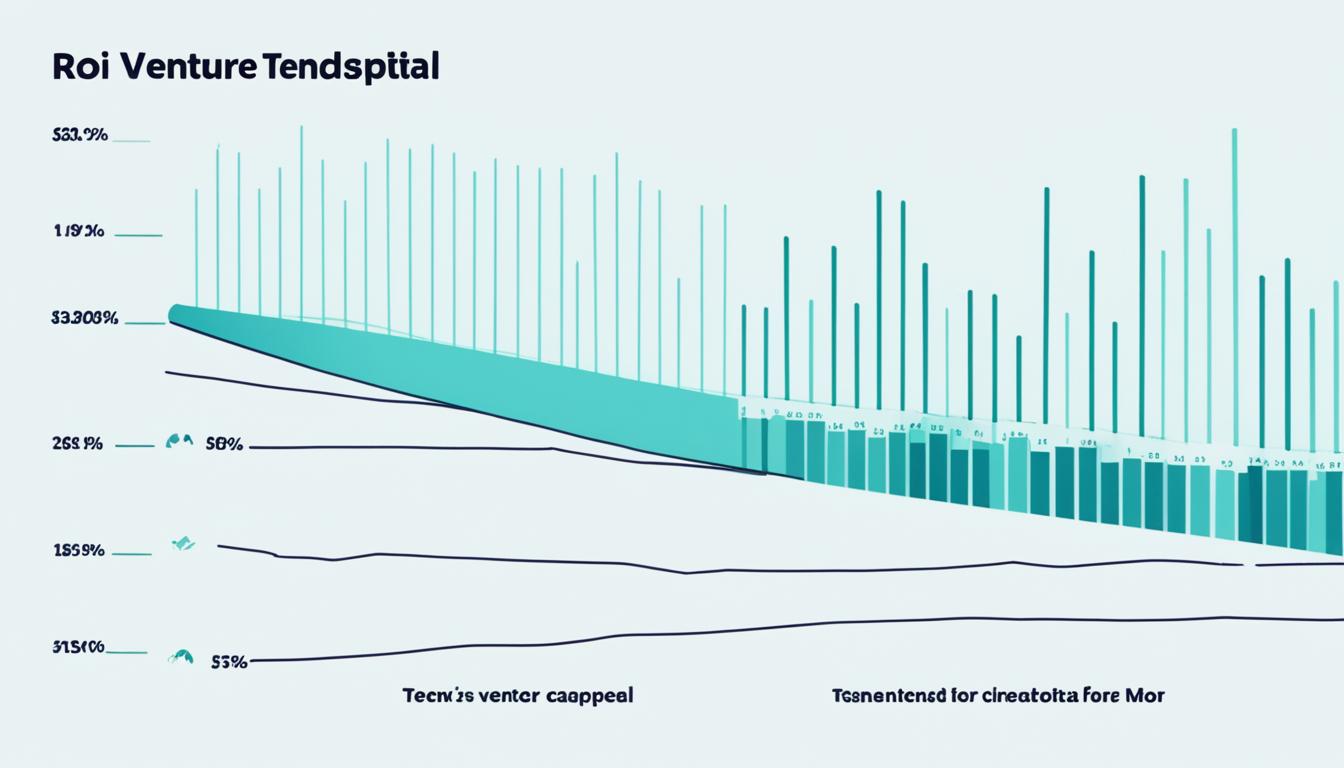

What is a good ROI for venture capital?

A good ROI for venture capital investments typically ranges from 20% to 30%, though exceptional startups can achieve much higher returns.