As a robotics startup expert, I’m excited to delve into the emerging trends shaping venture capital funding for innovative robotics companies in the flourishing U.S. market. The robotics industry has been experiencing rapid growth, attracting increasing interest from venture capitalists who recognize the immense potential for transformative technologies.

But what are the key areas that are attracting VC interest, and how can robotics startups navigate the funding landscape? Are there any success stories that can inspire aspiring entrepreneurs? In this article, I’ll explore the evolving venture capital landscape for robotics startups in the United States, uncovering the strategies, challenges, and opportunities that define this dynamic industry.

Key Takeaways

- The robotics industry is experiencing rapid growth, attracting increasing interest from venture capitalists.

- Venture capitalists are particularly drawn to areas like industrial robotics, service robotics, and AI-powered robotics.

- Emerging trends in the robotics VC landscape include the rise of startup accelerators and incubators, as well as the growing popularity of Robotics-as-a-Service (RaaS) models.

- Navigating the robotics funding landscape requires identifying the right investors, crafting a compelling pitch, and addressing regulatory and technological risks.

- Successful robotics startups have demonstrated strong teams, robust intellectual property portfolios, and the ability to showcase market traction and revenue potential.

Introduction to Robotics Venture Capital Landscape

The robotics industry has been experiencing exponential growth in recent years, driven by advancements in technology, the increasing adoption of automation across various sectors, and the growing demand for intelligent machines to enhance productivity and improve human lives. As the robotics market continues to evolve, venture capitalists have taken a keen interest in this dynamic sector, recognizing the immense potential for innovation and disruption.

Robotics: A Rapidly Growing Industry

The robotics industry has been at the forefront of technological innovation, with advancements in areas such as artificial intelligence (AI), machine learning, and sensor technology. These advancements have enabled the development of increasingly sophisticated and versatile robots that can be deployed across a wide range of applications, from manufacturing and industrial automation to healthcare, logistics, and even household tasks. As the demand for robotics solutions continues to rise, the industry has experienced significant growth, attracting the attention of venture capitalists seeking to invest in the next generation of transformative technologies.

The Role of Venture Capitalists in Robotics Innovation

Venture capitalists have played a crucial role in fueling the growth of the robotics industry, providing the necessary funding and resources to support the development and commercialization of innovative robotics startups. By investing in companies that are pushing the boundaries of what’s possible with robotics, these venture capitalists are helping to drive the industry forward and shape the future of automation, AI-powered machines, and intelligent systems. From industrial robotics solutions to service robotics designed to enhance everyday life, venture capitalists have recognized the immense potential of this rapidly evolving sector.

Key Areas Attracting VC Interest in Robotics

As the robotics industry continues to revolutionize various sectors, venture capitalists have taken a keen interest in several key areas that offer immense potential for growth and innovation. From automating manufacturing processes to enhancing everyday life, the robotics landscape has captured the attention of investors seeking to back the next generation of transformative technologies.

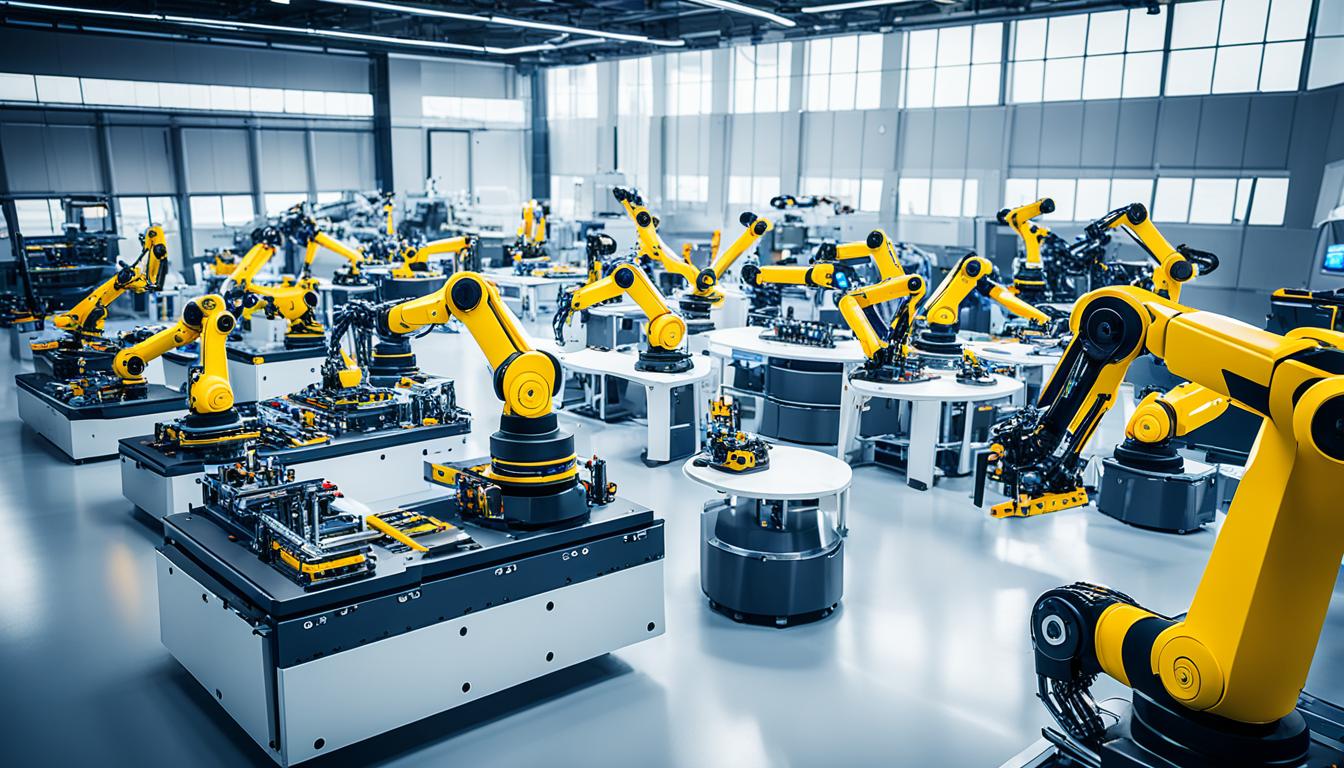

Industrial Robotics: Automating Manufacturing

One of the primary focus areas for venture capitalists in the robotics space is industrial robotics. The increasing demand for automation and greater efficiency in manufacturing has driven significant investment in startups developing advanced robotic systems for industrial applications. Venture capitalists recognize the potential for industrial robotics to streamline production, improve quality control, and reduce labor costs, making it an attractive area for funding robotics startups.

Service Robotics: Enhancing Everyday Life

Beyond the industrial realm, venture capitalists have also shown a growing interest in service robotics, which are designed to assist and enhance the everyday lives of consumers. From autonomous vacuum cleaners and lawn mowers to delivery robots and personal assistants, the service robotics sector has captured the imagination of investors who see the potential for these technologies to transform various aspects of daily life. Startups developing innovative service robotics solutions are often viewed as attractive investment opportunities.

AI-Powered Robotics: The Future of Intelligent Machines

As artificial intelligence (AI) continues to advance, venture capitalists have also turned their attention to the intersection of robotics and AI. Startups leveraging cutting-edge AI technologies to create intelligent, autonomous robotic systems are generating significant interest from investors. From self-driving cars to advanced drones and industrial robots, the integration of AI is seen as a crucial driver of the next generation of robotics, making it a high-priority area for venture capital funding.

Across these diverse domains, venture capitalists are actively seeking out robotics startups that are poised to disrupt industries, enhance human capabilities, and drive technological progress. By identifying and supporting the most promising innovations in the robotics sector, these investors play a crucial role in shaping the future of this rapidly evolving industry.

What are the emerging trends in venture capital funding for robotics startups?

As the robotics industry continues to evolve, several exciting trends are shaping the venture capital landscape for innovative robotics startups. One particularly notable development is the rise of dedicated robotics startup accelerators and incubators, which are providing essential resources, mentorship, and funding opportunities to help these cutting-edge companies get off the ground.

Rise of Robotics Startup Accelerators and Incubators

Recognizing the immense potential of the robotics sector, a growing number of venture capital firms and industry leaders have established specialized accelerator and incubator programs to support robotics startups. These programs offer access to industry expertise, state-of-the-art facilities, and valuable networking opportunities, empowering young robotics companies to refine their technologies, validate their business models, and secure crucial early-stage funding.

Increased Focus on Robotics-as-a-Service (RaaS) Models

Another emerging trend is the increased focus on Robotics-as-a-Service (RaaS) business models among venture capitalists. RaaS, which involves providing robotics solutions and services on a subscription or pay-per-use basis, is appealing to investors due to its recurring revenue streams and scalable growth potential. Startups that can demonstrate a robust RaaS offering, coupled with a strong value proposition and market traction, are particularly attractive to robotics-focused venture capitalists.

These emerging trends in venture capital funding for robotics startups highlight the growing enthusiasm and investment activity within this dynamic industry. As the adoption of robotics and automation technologies continues to accelerate across various sectors, the opportunities for innovative startups to disrupt and reshape the market will only continue to expand, further driving the interest and involvement of venture capitalists in the robotics startup landscape.

Navigating the Robotics Startup Funding Landscape

For robotics startups seeking venture capital funding, navigating the complex landscape can be a daunting task. However, there are strategies and best practices that can increase the likelihood of securing investment from the right investors. By understanding the preferences and investment criteria of venture capitalists in the robotics space, startups can craft compelling pitches that showcase their innovative technologies, strong team, and promising market potential.

Identifying the Right Investors for Your Robotics Startup

The key to successful venture capital funding for robotics startups is to identify investors who are actively seeking opportunities in this rapidly growing industry. Robotics venture capital firms, such as Kleiner Perkins, Softbank Vision Fund, and Playground Global, have demonstrated a strong appetite for investing in cutting-edge robotics technologies, from industrial automation to service robotics and AI-powered solutions. It’s essential to research and network with these specialized investors to understand their investment criteria, sector focus, and portfolio strategies.

Factors like industry expertise, access to valuable resources, and alignment with the startup’s vision can be just as important as the investment amount when selecting the right venture capitalists. Robotics startups should also consider the added value that prospective investors can bring, such as strategic guidance, industry connections, and follow-on funding support.

Crafting a Compelling Pitch for Robotics Venture Capitalists

Once the right investors have been identified, robotics startups must craft a compelling pitch that clearly communicates their unique value proposition, competitive advantages, and growth potential. The pitch should not only demonstrate the technical capabilities of the robotics solution but also highlight the startup’s understanding of the target market, customer pain points, and the potential for scalable, sustainable growth.

Successful robotics startup pitches often include detailed market analysis, prototypes or working models, evidence of customer traction, and a well-articulated go-to-market strategy. Highlighting the team’s domain expertise, industry accolades, and past successes can also help to build credibility and investor confidence.

By navigating the complex robotics venture capital landscape and crafting a compelling pitch, robotics startups can increase their chances of securing the funding they need to scale their innovative technologies and drive the future of the robotics industry.

Challenges and Risks in Robotics Venture Capital

As the robotics industry continues to attract significant venture capital funding, it also presents unique challenges and risks that must be carefully navigated. From regulatory hurdles to technological uncertainties, robotics startups and their investors face a complex landscape that requires a nuanced understanding of the sector.

Regulatory Hurdles and Ethical Considerations

The robotics industry is subject to a range of regulatory requirements, which can vary across different jurisdictions and applications. Robotics startups must navigate a web of safety standards, data privacy laws, and ethical guidelines that govern the development and deployment of their technologies. Failure to address these regulatory hurdles can not only delay product launches but also expose companies to legal and reputational risks.

Moreover, the rise of advanced robotics, particularly in the realms of artificial intelligence and autonomous systems, has sparked important discussions around the ethical implications of these technologies. Robotics startups must carefully consider issues such as algorithmic bias, privacy protection, and the impact of their products on human welfare. Addressing these ethical considerations is crucial for building public trust and ensuring the responsible growth of the robotics sector.

Managing Technological Risks and Uncertainties

The robotics industry is characterized by a high degree of technological complexity and rapid innovation. Robotics startups face the constant challenge of staying ahead of the curve, anticipating technological breakthroughs, and mitigating the risks associated with unproven or rapidly evolving technologies. Investors in the robotics venture capital space must be cognizant of these technological risks and uncertainties, which can impact the timeline, performance, and commercial viability of robotics startups.

Factors such as the scalability of production, the reliability of sensor systems, and the integration of advanced software and hardware components can all pose significant challenges for robotics startups seeking to secure venture capital funding. Effective risk management strategies, robust testing protocols, and a deep understanding of the technological landscape are essential for navigating these challenges and instilling confidence in potential investors.

| Robotics Startup | Funding Raised | Investment Highlights |

|---|---|---|

| Figure | $675 million series B | Developing humanoid robotics |

| 1X Technologies | $100 million series B | Focused on humanoid service robots |

| Unitree | $139 million | Quadripedal robot maker |

| GrayMatter Robotics | $24.1 million | Manufacturing-focused startup with support from 3M Ventures |

| Intuition Robotics | $83 million total | AI companion hardware and software for older individuals |

Success Stories: Robotics Startups That Scored Big VC Deals

The robotics industry has seen several remarkable success stories of startups that have attracted significant venture capital funding, showcasing the immense potential and growing investor interest in this rapidly evolving sector. These success stories serve as inspirational examples for aspiring robotics entrepreneurs seeking to secure the necessary funding to transform their innovative ideas into reality.

One prominent example is Anki, a San Francisco-based robotics startup that developed advanced AI-powered consumer robotics products. In 2013, Anki secured $50 million in Series A funding from venture capital firms like Index Ventures, Two Sigma Ventures, and Andreessen Horowitz, among others. This early-stage investment allowed Anki to accelerate the development and commercialization of its robotics technology, ultimately leading to the successful launch of its flagship product, Anki Overdrive, a high-tech race car game that blended physical toys with digital gameplay.

Another success story is Fetch Robotics, a leading provider of autonomous mobile robots for logistics and material handling applications. In 2015, Fetch Robotics raised $20 million in Series A funding, led by Brightstar Capital Partners and Silicon Valley Bank. This influx of capital enabled the company to expand its product offerings, strengthen its research and development efforts, and solidify its position as a key player in the industrial robotics market.

| Robotics Startup | VC Funding Raised | Key Investors | Product/Service Focus |

|---|---|---|---|

| Anki | $50 million (Series A) | Index Ventures, Two Sigma Ventures, Andreessen Horowitz | AI-powered consumer robotics |

| Fetch Robotics | $20 million (Series A) | Brightstar Capital Partners, Silicon Valley Bank | Autonomous mobile robots for logistics and material handling |

| Bossa Nova Robotics | $25 million (Series B) | Cota Capital, EDBI, Intel Capital, Cota Capital | Retail inventory robots |

| Nuro | $940 million (Series B and B-1) | SoftBank Vision Fund, Greylock Partners, Gaorong Capital | Autonomous delivery vehicles |

Other notable success stories include Bossa Nova Robotics, which raised $25 million in Series B funding to develop advanced retail inventory robots, and Nuro, a startup focused on autonomous delivery vehicles, which secured a staggering $940 million in Series B and B-1 funding from investors like SoftBank Vision Fund and Greylock Partners.

These success stories demonstrate the increasing appetite of venture capitalists for robotics startups that are pushing the boundaries of innovation and addressing crucial industry needs. As the robotics startup landscape continues to evolve, we can expect to see more groundbreaking companies secure significant robotics venture capital funding, further catalyzing the growth and transformation of the robotics industry.

The Future of Robotics Venture Capital

As the robotics industry continues to evolve, venture capitalists are closely monitoring the emergence of new technologies and trends that will shape the future of their investments. From advancements in artificial intelligence (AI) to the growing demand for specialized robotics solutions, the robotics venture capital landscape is poised for significant transformation.

Emerging Technologies Shaping the Robotics Investment Landscape

The rapid advancements in AI have been a major driver of venture capital interest in the robotics sector. With the cost of robotics components decreasing by up to 90% since 2000 and a 400% increase in AI investment over the past five years, the integration of AI-powered capabilities is becoming increasingly prevalent. Venture capitalists are particularly intrigued by the potential of AI-driven robotics to revolutionize industries, from industrial automation to service robotics applications that enhance everyday life.

Concurrently, the rise of vertical robotics companies, which specialize in targeted solutions for specific industries, has captured the majority of venture funding in the robotics sector. As the demand for tailored, high-performance robotics solutions continues to grow, venture capitalists are recognizing the immense potential of these vertical robotics startups to disrupt traditional markets and create new opportunities.

Predictions for VC Funding Trends in Robotics

The robotics industry has experienced a significant shift in venture capital funding trends. While autonomous vehicles (AV) previously dominated the robotics funding landscape, accounting for over 50% of investments, the sector has faced a decline in 2022. Conversely, vertical robotics companies have emerged as the primary recipients of venture capital, reflecting the growing demand for specialized robotic solutions.

However, the broader robotics investment landscape has faced challenges in recent years. Investments in robotics declined by over 50% in the first half of 2023 compared to 2022, which itself was down by 30% from 2021. This decline has been observed across both early-stage and mid- to late-stage deals, as venture capitalists navigate the uncertain economic conditions and seek to mitigate risks.

Despite these challenges, the future of robotics venture capital remains promising. The second half of 2023 is expected to see high-profile funding rounds for companies like Anduril, Aurora, and Stack AV, indicating that venture capitalists continue to recognize the transformative potential of the robotics industry. As new technologies and innovative business models emerge, the robotics startup landscape is poised to attract renewed attention from venture capitalists seeking to capitalize on the industry’s vast growth opportunities.

Strategies for Robotics Startups to Attract VC Funding

As a robotics startup founder, securing venture capital funding is crucial to propel your business forward. To increase your chances of success, there are several key strategies you can employ that will resonate with venture capitalists (VCs) in the robotics investment landscape.

Building a Strong Team and Intellectual Property Portfolio

Venture capitalists place a high value on the strength and expertise of your founding team. Assemble a diverse group of experienced professionals with complementary skills in areas like robotics engineering, software development, and business strategy. Demonstrate your team’s ability to execute and deliver innovative solutions.

In addition, building a robust intellectual property (IP) portfolio can significantly bolster your startup’s appeal to VCs. Actively protecting your innovations through patents, trademarks, and copyrights showcases the uniqueness and defensibility of your technology, which is a crucial factor in the robotics startup funding process.

Demonstrating Market Traction and Revenue Potential

Venture capitalists are drawn to robotics startups that have already gained traction in the market and shown the potential for scalable revenue growth. Highlight your customer acquisition efforts, partnerships, and any early signs of market acceptance for your products or services. Provide data-driven evidence of your startup’s ability to capture a significant share of the robotics venture capital market.

Furthermore, present a clear and compelling financial model that outlines your path to profitability and the long-term revenue potential of your robotics startup funding initiatives. VCs will be interested in your ability to generate sustainable cash flow and ensure a favorable return on their investment.

| Key Strategies | Benefits to Robotics Startups |

|---|---|

| Building a Strong Team and IP Portfolio | Demonstrates expertise, innovation, and defensibility of technology |

| Showcasing Market Traction and Revenue Potential | Highlights scalability, growth opportunities, and path to profitability |

Robotics Venture Capital in the Global Context

While the United States has emerged as a leading hub for robotics innovation and venture capital investment, the global landscape for robotics startups and funding is increasingly diverse and interconnected. As venture capitalists and robotics enthusiasts keep a keen eye on the latest trends, it’s essential to understand the regional hotspots driving this industry’s growth and the cross-border collaborations shaping its future.

Regional Hotspots for Robotics Innovation and Investment

Beyond the thriving robotics ecosystem in the U.S., other regions have also established themselves as hubs for innovation and investment. For instance, China has seen a surge in robotics startups and VC funding, particularly in the areas of industrial automation, service robots, and AI-powered systems. European nations, such as Germany and the United Kingdom, have also emerged as prominent players, leveraging their strong engineering expertise and well-developed manufacturing sectors to foster robotics advancements.

Cross-Border Collaborations and Partnerships

As the robotics industry becomes more globalized, we’re witnessing a rise in cross-border collaborations and partnerships between startups, established companies, and venture capitalists. These international alliances allow for the exchange of knowledge, technology, and resources, driving the industry forward on a worldwide scale. For instance, Silicon Valley-based robotics firms have forged partnerships with Chinese counterparts to tap into the vast domestic market and leverage local expertise, while European robotics startups have collaborated with U.S. VC firms to secure the funding and support needed to scale their operations.

By understanding the global context of robotics venture capital, robotics startups can explore new avenues for growth, access a wider pool of investors, and stay ahead of the curve in this rapidly evolving landscape. As the industry continues to transcend national borders, the future of robotics innovation will be shaped by the synergies and collaborations that emerge across the world.